In 2023, nearly 176,000 households paid the real estate wealth tax (IFI) totaling 1.9 billion euros, representing a 7.3% increase from 2022. The average amount paid, however, decreased slightly to 11,100 euros. The IFI replaced the solidarity tax on wealth (ISF) in 2018 and exclusively applies to real estate assets exceeding 1.3 billion euros net, with a 30% deduction for the main residence. The aim of this change was to redirect savings towards business financing and curb tax exile.

The transition from ISF to IFI, a flagship measure of Emmanuel Macron’s 2017 presidential campaign, led to a significant decrease in the number of households subject to the tax. In 2017, the last year of ISF implementation, there were nearly 360,000 taxable households. The average age of households subject to IFI in 2023 is 70 years, with nearly 70% of them being aged 65 or older. The first tax bracket, covering taxable assets between 1.3 million and 2.5 million euros, accounts for three quarters of taxed households, contributing 32% of the tax revenue from IFI.

On the other end of the spectrum, 1% of IFI households have assets exceeding 10 million euros and paid an average of 151,000 euros in IFI in 2023. They contribute 14% to the total IFI collected by the state. The DGFIP has noted an increase in households falling in the “median” brackets (between 2.5 million and 10 million euros of net taxable assets), contributing to the overall growth in revenue from this tax. The deadline for the IFI declaration in 2024 is approaching for concerned taxpayers, similar to the income tax declaration deadline at the end of May or beginning of June.

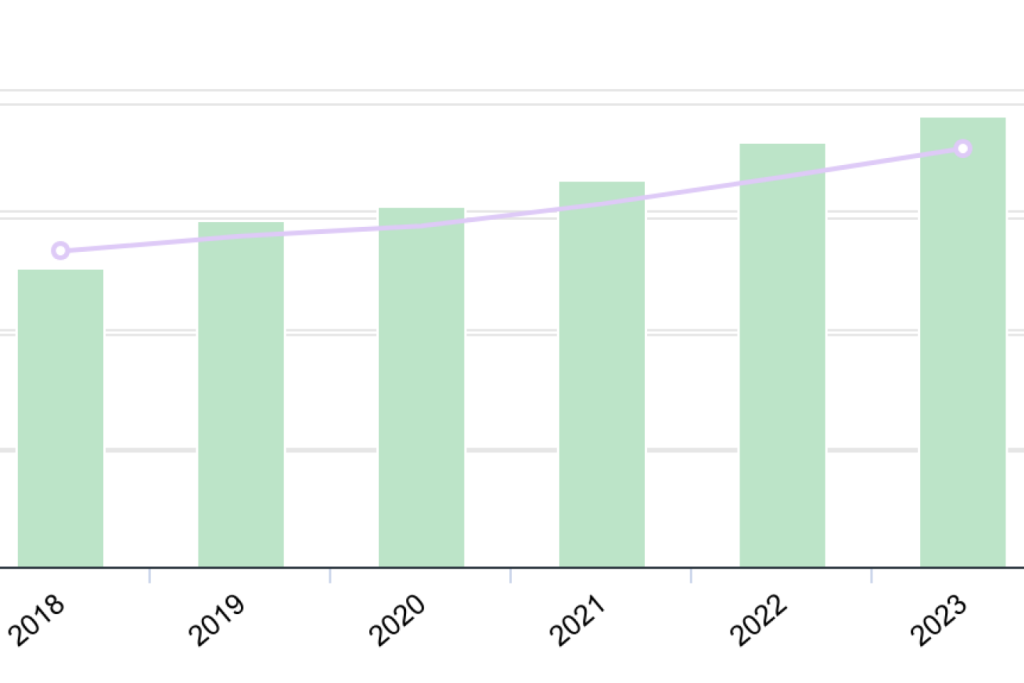

Overall, the dynamics observed in previous years continue in 2023, with an increasing number of households paying the IFI. While the total amount collected and the number of taxpayers have seen a rise, the average amount paid has slightly decreased. The IFI targets households with high real estate wealth and has certain deductions in place, such as for the main residence. These measures were introduced to encourage investment in businesses and combat tax evasion. The distribution of taxpayers in different brackets shows a concentration in the lower ranges, but with a notable contribution from the wealthiest households as well.