Tuesday’s release of the Producer Price Index (PPI) for April showed a higher than expected increase of 0.5%. However, despite this, markets remained relatively stable as the year-on-year change for the headline index was only 2.2%. Healthcare services and insurance rates were blamed for the recent inflation data upsurge. Healthcare services saw a small increase of 0.2%, while insurance rates remained constant at 0.0%.

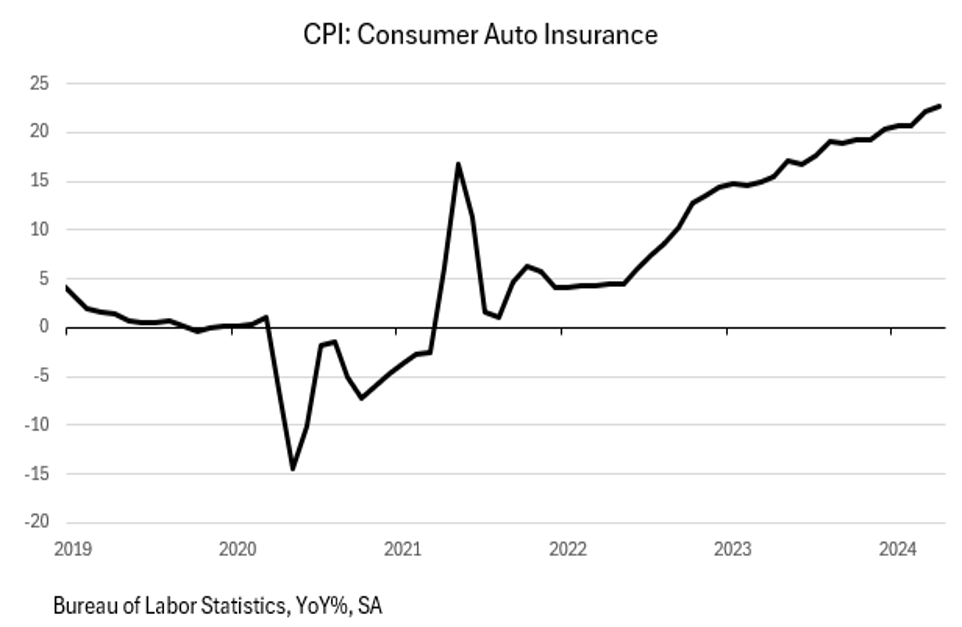

On Wednesday, the Consumer Price Index (CPI) for April was released and showed a cooler reading than expected. The headline number showed a 0.3% increase month-on-month, lower than the anticipated 0.4%. Year-on-year numbers were 3.4% for the headline index and 3.6% for the core index. The rise in the CPI has been attributed to categories such as auto insurance and health care services. However, disinflation and deflation were noted as being prevalent in the current economic climate.

Measurement issues in the CPI’s shelter component have been highlighted in previous blogs, with a significant upward bias attributed to the use of a long lag in calculating the index. If the shelter component is removed from the core, the year-on-year inflation rate would be 2.1%, aligning with the Federal Reserve’s targets. Some goods prices, such as new auto prices and used car prices, have been deflating. Appliance and furniture prices have also seen decreases, indicating a trend towards disinflation and deflation.

Recent data suggests that the US consumer may be reaching a point of exhaustion, with savings rates dropping and credit card balances at all-time highs. Delinquencies are rising, and consumption is slowing. Retail sales for April were flat on a nominal basis and fell by 0.3% in real terms. This decline in consumer spending is likely to impact the GDP, with the consumption portion comprising 70% of the total.

Economic surveys including the Federal Reserve Bank’s manufacturing surveys indicate a recession in the manufacturing sector. The National Association of Home Builders Index saw a decline, with high mortgage rates being blamed for the softness in the housing market. Housing starts and building permits also fell, affecting both single-family and multi-family housing markets. These trends are expected to continue putting downward pressure on the CPI.

Despite the weakening economic conditions, financial markets have continued to rise. Market participants are pricing in two potential rate cuts by the Federal Reserve, one in September and one in December, compared to previous expectations of none. The lower interest rates are seen as a positive for financial markets, although the continued hawkish comments from Federal Open Market Committee (FOMC) members have kept the view on rate cuts cautious. Overall, markets are optimistic about the prospect of lower rates despite the challenging economic environment.