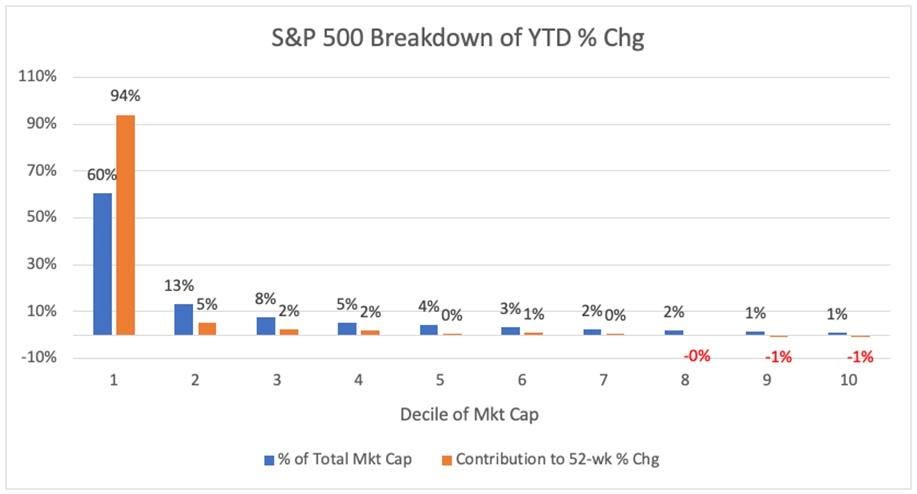

The large capitalization market averages have experienced a good year, with the S&P 500 up by around 14% so far. However, the gains have been highly concentrated, with the top-50 stocks by market capitalization in the S&P 500 accounting for nearly all of the gains. Nvidia alone makes up approximately 35% of the total gains, while the top-10 stocks contribute to nearly 80% of the S&P 500 gains. Additionally, the top-10 stocks have increased their share of the total market cap from 32% to nearly 38%.

The concentration and lack of breadth in the market can be further examined through relative strength lines of cap-weighted versus equal-weighted indices and oscillators of equal-weighted indices versus cap-weighted ones. These tools show how much the top stocks have dominated performance, with the select mega-cap stocks outperforming historical levels. This dominance of the major indexes has come at the expense of small capitalization stocks, which have been on a downward trend for three years.

Periods of market concentration have historically led to the end of bull markets, as seen in 2000 and in 1973. The current state of high concentration in the market may eventually result in a shift in performance, where the rest of the market catches up. Signs of a potential change in market dynamics include a resurgence in the number of breakouts across the market and a pickup in other groups or themes outside of mega-cap Technology.

While it is unlikely that the current condition of a small number of stocks driving the market higher will continue for much longer, it is uncertain whether a decline in the leaders or an increase in performance of lagging segments will occur. Investors are advised to monitor for any signals indicating a change in market dynamics. Kenley Scott, Director, Global Sector Strategist at William O’Neil + Co., highlights the importance of staying alert and being prepared for any potential shift in the market.

It is crucial for investors to remain cautious and vigilant in the current market environment, as the dominance of a few large-cap stocks may not be sustainable in the long term. The data presented in the article sheds light on the challenges posed by market concentration and the potential implications for the broader market. The insights provided by industry experts serve as a reminder for investors to stay informed and adapt to changing market conditions.