A recent edition of Forbes Tax Breaks newsletter delves into various tax-related topics, including filial laws, offshore tax evasion, crypto tax reporting, proposed tax changes, theft and fraud deductions, Pass-Through Entity Tax, and recent IRS initiatives. The newsletter highlights Pennsylvania’s filial support laws, which can hold family members responsible for relatives’ medical bills, triggering confusion and financial complications. The proposed “Stop Bankrupting Pennsylvanians Over Family Medical Bills” Act seeks to amend these laws in the state.

Furthermore, the newsletter discusses offshore tax evasion, with the Senate Budget Committee focusing on addressing corporate loopholes and tax evasion by corporations and high-net-worth individuals. The committee is divided on the approach, with different views on relying on the Foreign Account Tax Compliance Act or whistleblowers. The newsletter also covers the IRS’s efforts to tax crypto and digital assets through the release of Form 1099-DA and proposed regulations. Additionally, it explores the White House’s budget proposal, including an excise tax on private space companies and new capital gains rates.

Moreover, the newsletter provides insights on theft and fraud deductions post-2018 tax reform and the Pass-Through Entity Tax workaround for state and local tax deductions limitations. It also features a reader question on correcting a double tax filing mistake and highlights recent developments in tax court cases, civil penalties, and charitable deductions lawsuits. Additionally, the newsletter mentions upcoming tax events, changes in ABA membership dues, the IRS Nationwide Tax Forum, and industry news, such as the success of the IRS Direct File tool and initiatives to enhance digital sales transactions.

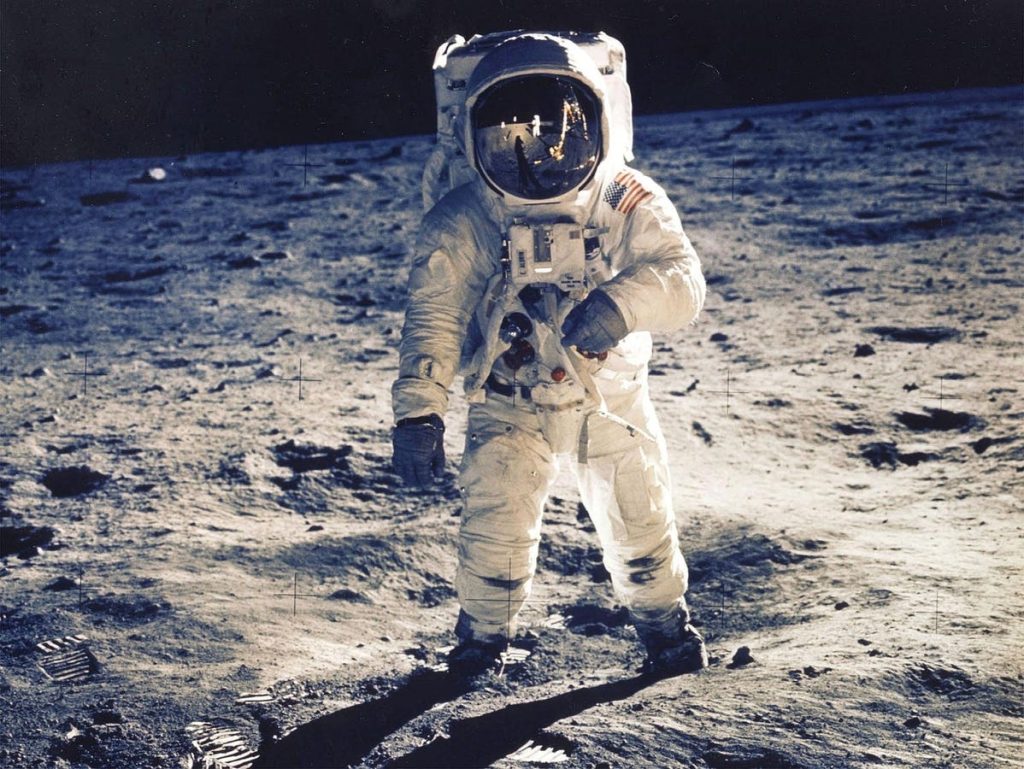

In a lighter note, the newsletter includes a trivia question related to space travel and tax filing, along with responses from the team on their willingness to travel to space. A trivia answer reveals that astronaut Jack Swigert, a member of the Apollo 13 crew, once inquired about applying for a tax filing extension from space. The newsletter also invites feedback from readers to improve future editions. Overall, the newsletter offers a comprehensive overview of current tax-related issues, legislative developments, and IRS initiatives, appealing to individuals interested in tax policy, compliance, and financial planning.