The DividendRank formula by Dividend Channel ranks thousands of dividend stocks to identify those with strong fundamentals and inexpensive valuations. Nike is currently ranked in the top 25% of the coverage universe, making it an interesting option for investors to further research. Additionally, shares of Nike entered into oversold territory on Monday, trading as low as $91.691 per share, with a Relative Strength Index (RSI) reading of 29.8, below the average RSI of 59.9 for dividend stocks covered by Dividend Channel.

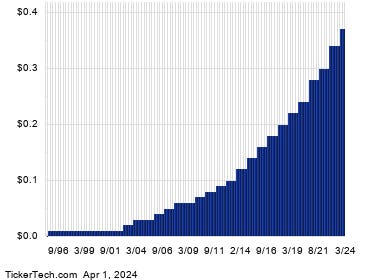

A falling stock price can present an opportunity for dividend investors to capture a higher yield, as NKE’s annualized dividend of 1.48/share yields 1.57% based on the recent share price of $93.98. This may be a signal for bullish investors to consider entry point opportunities on the buy side, as the heavy selling may be exhausting itself. Examining Nike’s dividend history can also help investors in deciding if they are bullish on the stock, as dividends are not always predictable.

Investors analyzing Nike’s dividend history should take note of its recent annualized dividend of 1.48/share, currently paid in quarterly installments. The stock’s RSI reading of 29.8 could be seen as a sign that the recent selling pressure is potentially nearing its end, presenting a potential opportunity for investors looking to buy. Monitoring the company’s fundamentals and dividend history can also provide valuable insights for investors considering NKE as a potential investment.

Overall, with Nike’s strong fundamentals and inexpensive valuation, combined with its recent entry into oversold territory, the stock presents an attractive option for investors to consider further research. A closer examination of Nike’s dividend history and financial metrics can help investors make informed decisions about whether to buy the stock. Ultimately, the combination of strong fundamentals, an oversold position, and a competitive dividend yield make Nike a stock worth considering for dividend investors seeking opportunities in the market.

In conclusion, Nike’s current ranking in the top 25% of the coverage universe, along with its oversold position and competitive dividend yield, make it a compelling option for investors looking to capitalize on potential opportunities in the market. By conducting thorough research into Nike’s fundamentals, dividend history, and valuation metrics, investors can make informed decisions about whether the stock aligns with their investment objectives. As the stock market continues to present new opportunities, Nike stands out as a strong contender for dividend investors seeking to enhance their portfolio.