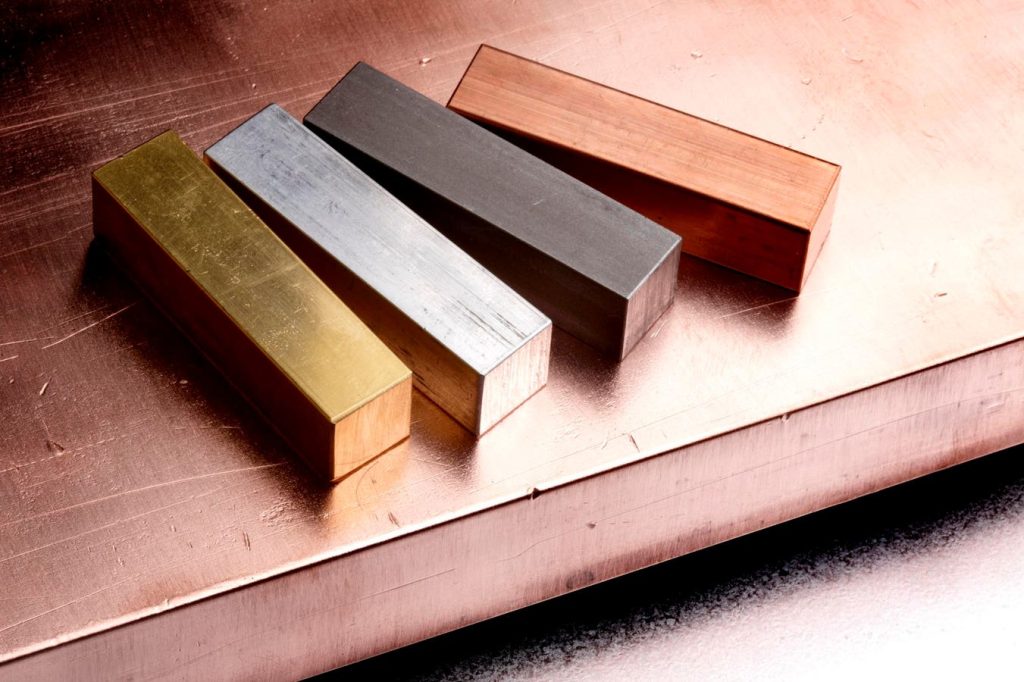

In the midst of escalating geopolitical tensions, two key commodities have emerged as major players in global financial markets: gold and copper. Both metals have been thriving amidst market volatility, making them an important area of interest for savvy investors. Gold, a traditional store of value during turbulent times, has seen prices near all-time highs, with central banks in emerging markets increasing their gold reserves. The strategic shift towards gold as a reserve currency is evident as institutions purchased a record 290 tons of gold in the first quarter of 2024, according to the World Gold Council (WGC).

While gold remains a safe haven, copper is also making waves due to its widespread industrial applications. Often referred to as “Dr. Copper” for its ability to predict economic trends, copper has seen a significant price increase, reaching a two-year high. This surge is supported by strong global economic activity, driven by the demand for energy transition technologies like electric vehicles, wind, and solar. Despite challenges in production, such as stoppages and declining ore grades in major producers, the global copper market is tightening, with rebound expected in 2025.

The manufacturing sector is providing further insights into the demand for industrial metals. The JPMorgan Global Manufacturing PMI indicates continued expansion, suggesting sustained demand for commodities like copper. Rising input costs and selling prices within the sector point to building price pressures, which may contribute to inflation concerns. Economic indicators like these are crucial for investors to consider as they assess potential impacts on commodity prices and investment returns.

The shift towards a low-carbon economy is not just a policy preference but a significant investment theme. Global investment in the energy transition reached $1.8 trillion in 2023, nearly doubling from 2020 levels. Regions like Europe, the Middle East, and Africa are expected to drive further demand for copper due to its essential role in electrification and renewable energy infrastructures. Balancing portfolios with both gold and copper is a wise move for investors. Gold remains a critical asset in any diversified portfolio, especially for hedging against geopolitical risk and potential inflation. Meanwhile, copper presents a compelling growth story tied to the global economic recovery and the transition to green energy.

In conclusion, both gold and copper are poised to play significant roles in global financial markets amidst escalating geopolitical tensions. With gold serving as a safe haven and central banks increasing their reserves, the metal continues to see strong demand. On the other hand, copper’s price surge is supported by global economic activity and the transition to green energy. Investors can benefit from both metals by balancing their portfolios with a 10% weighting in gold, split between physical gold and gold mining stocks, mutual funds, and ETFs, alongside investing in copper as a valuable growth opportunity.