The recent Federal Reserve meeting and the release of the jobs report were anticipated to have a significant impact on financial markets. Surprisingly, despite a weaker-than-expected jobs report, the markets reacted positively, with the equity markets ending the week up significantly. It appears that bad economic news is now seen as good financial news as investors are hopeful for rate cuts.

At the Fed meeting held on April 30 to May 1, Chairman Powell reassured the markets that the higher-than-expected inflation data in Q1 was just a temporary bump in the road. The Fed remains confident in achieving its 2% inflation goal without the need for tighter policy. The dovish tone of the meeting statement and press conference signaled a shift in Fed sentiment towards potential rate cuts in the future.

The May 3rd Non-Farm Payrolls report showed weaker job growth than expected, with other labor market indicators also reflecting weakness. The U3 and U6 unemployment rates increased, and layoffs in April reached a three-year high. The labor market is rapidly softening, leading markets to anticipate two rate cuts this year, compared to earlier expectations of only one or none.

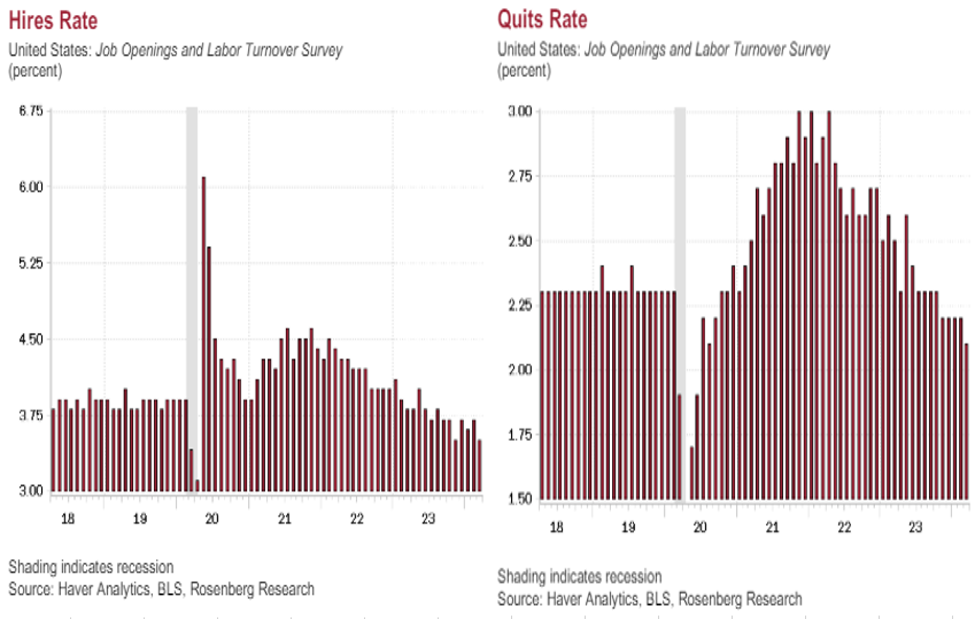

In addition to the jobs report, other indicators such as the JOLTS report and Challenger Gray and Christmas layoff report show a weakening labor market. The Fed has indicated that any unexpected weakness in the labor market could prompt rate cuts, especially in light of rising layoff announcements and slowing hiring rates.

Despite not cutting rates at the recent meeting, the Fed announced a reduction in its monthly Treasury sales, effectively easing its tightening policies. This move, along with the anticipation of future rate cuts, has pushed equity prices higher and caused bond markets to celebrate lower rates. Earnings reports have shown a trend of consumer frugality, with several companies reporting lower sales and profits, further indicating economic softening.

Manufacturing continues to contract, with the ISM PMI showing contraction in April. Consumer Confidence has fallen, and deflation in goods and weakening inflation in services are becoming evident. The Fed’s acknowledgment of a weakening economy and declining inflation suggests the possibility of rate cuts in the coming meetings. The ongoing concerns about Commercial Real Estate foreclosures add to the economic uncertainty as the Fed navigates the path forward.