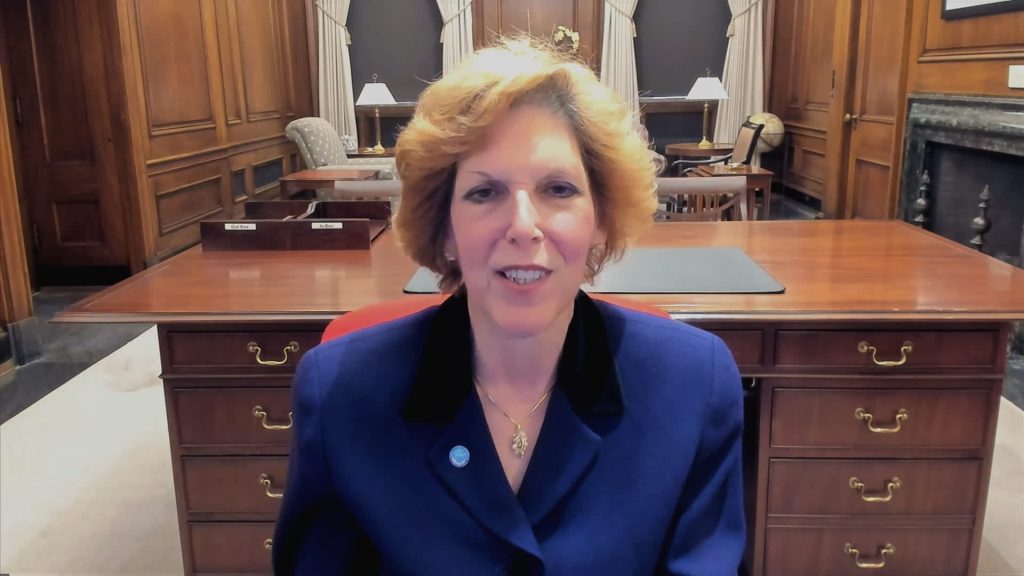

Cleveland Federal Reserve President Loretta Mester expects interest rate cuts this year, but has ruled out the next policy meeting in May. Mester believes that the long-run path for interest rates is higher than previously thought by policymakers. San Francisco Fed President Mary Daly also anticipates rate cuts this year, but stated that they will not happen until there is more convincing evidence that inflation has been subdued. Both central bank officials acknowledged progress in controlling inflation as the economy continues to grow. Mester did not provide specifics on the timing or extent of potential rate cuts, emphasizing the need for more data to increase confidence in the downward trajectory of inflation.

Mester highlighted the importance of additional inflation readings to determine whether recent data points indicating higher inflation were temporary fluctuations or signs of stalling progress. She expressed uncertainty about having sufficient information to make a decision on rate cuts at the upcoming Federal Open Market Committee (FOMC) meeting, and suggested that more evidence of inflation moving toward the 2% target was necessary before reducing rates. The FOMC has held its key overnight borrowing rate between 5.25%-5.5% since July 2023, reflecting the committee’s cautious approach in the absence of clear inflation trends.

Futures traders anticipate the Fed will start easing in June and cut rates by three-quarters of a percentage point by the end of the year, aligning with Daly’s projection of three rate cuts in 2023 as a reasonable baseline. Daly emphasized that projections are not guarantees, and the timing and extent of rate cuts are contingent on economic data and conditions. Mester shared Daly’s expectation of rate cuts while also suggesting that the long-run federal funds rate may be higher than the previously estimated 2.5%. She indicated that the neutral or “r*” rate, where policy is neither restrictive nor stimulative, could be at 3%.

Mester emphasized the importance of calibrating monetary policy to economic developments to avoid the need for aggressive action in the future. She acknowledged the limited room for maneuvering when interest rates were very low at the onset of the Covid pandemic, underscoring the need to carefully adjust policy based on evolving economic conditions. Both Mester and Daly emphasized the uncertainty surrounding the timing and extent of rate cuts, emphasizing the need for continued monitoring of inflation trends and economic growth. Daly reiterated that while rate cuts are anticipated, they are not imminent and will be contingent on data reflecting progress in controlling inflation.