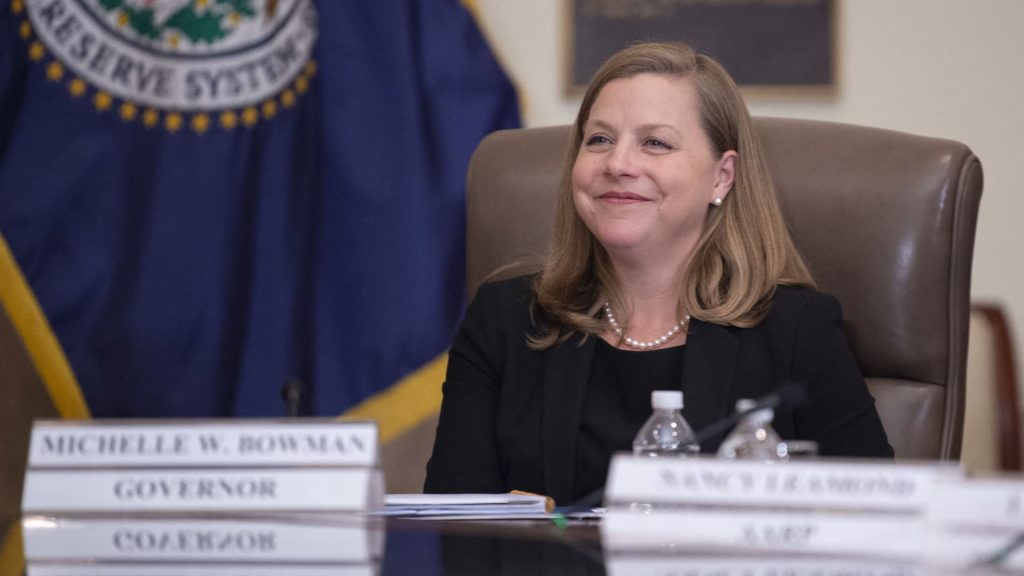

Federal Reserve Governor Michelle Bowman expressed concerns about the potential need for interest rates to move higher in order to control inflation, rather than the cuts that markets are expecting. She emphasized the importance of not easing policy too quickly and highlighted the possibility of future rate increases if progress on inflation stalls or reverses. As a permanent voting member of the rate-setting Federal Open Market Committee, Bowman’s stance has been more hawkish towards containing inflation since she took office in late 2018.

While Bowman’s most likely outcome is still a rate cut in the future, she stressed the presence of numerous upside risks to inflation that could delay this decision. Her speech to the Shadow Open Market Committee reflected the uncertainties surrounding the future of Fed policy, with recent statements from Chair Jerome Powell and other officials indicating a cautious approach to cutting rates. Atlanta Fed President Raphael Bostic suggested he sees only one cut this year, while Minneapolis Fed President Neel Kashkari stated that no cuts may be necessary if inflation does not decelerate further.

Market expectations for rate cuts this year are currently at three, but the timing of these cuts remains uncertain. FOMC members indicated three cuts in March, but there was variation in the pace and timing of future actions. Bowman emphasized the need to closely monitor economic data and remain cautious in considering changes to the stance of policy. She identified supply-side improvements, geopolitical risks, fiscal stimulus, housing prices, and labor market tightness as factors contributing to inflation pressures.

Bowman raised concerns about the uneven or slow progress in inflation readings over the past two months, particularly for core services. The upcoming release of the March consumer price index report will provide Fed officials with additional data to inform their decision-making. As the Fed navigates these uncertainties, Bowman’s emphasis on monitoring inflation trends and assessing economic risks underscores the importance of a cautious approach to future monetary policy adjustments.

In conclusion, Bowman’s remarks signal a potential divergence from market expectations regarding interest rate cuts, as she highlights the need to be mindful of upside risks to inflation. With uncertainties surrounding the future path of policy, including differing views among FOMC members and economic data releases, Fed officials are closely monitoring developments to determine the appropriate stance of monetary policy going forward. As the March consumer price index report approaches, the Fed’s assessment of inflation trends and economic risks will play a key role in shaping future policy decisions.