The first quarter of 2024 was great for the markets, with big rallies in stocks and gold. However, April saw a significant pullback, leading investors to wonder if this is just a temporary pause or a sign of more trouble ahead. MoneyShow contributors weigh in on the current state of stocks and gold, offering insights into the recent market movements.

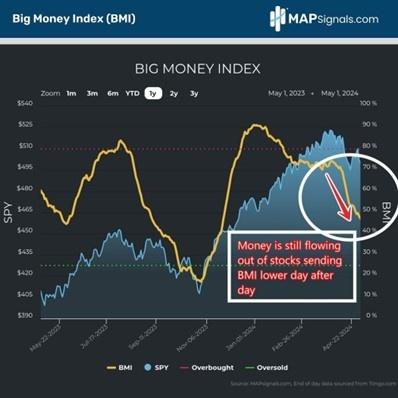

Lucas Downey from Mapsignals.com highlights the impact of institutional demand grinding to a halt, causing pain for growth stocks. Despite the ongoing dips and volatility in the market, he points to a major ultra-bullish signal approaching based on their Money Flows data. The Big Money Index has been in a free fall, but a monster bullish setup is forming, indicating a potential crowd-stunning rally later in the year.

Brien Lundin of the Gold Newsletter reflects on the recent sell-off in the gold market following a rapid increase in prices. While the drop was unsettling for many investors, Lundin sees it as a necessary correction to cool off the overbought market. He emphasizes the importance of gold as an investment and insurance in the current market environment.

Matthew Carr of Tipping Point Profits debunks the “Sell in May and Go Away” myth, highlighting the historical patterns of stock market performance during the summer months. While May is known for being a challenging month for stocks, Carr argues that investors shouldn’t completely buy into this philosophy as gains are still possible. He examines the average returns in different months to provide a balanced perspective on seasonal trading strategies.

Danielle Shay of Fivestartrader.com discusses the loss of momentum in sectors like technology and financials, pointing to more muted outlooks from company executives following Q1 earnings. She shares insights on options trading tactics and techniques, focusing on pattern recognition and sentiment extremes to identify profit opportunities. Shay also previews her upcoming presentation at the MoneyShow Masters Symposium in Las Vegas, highlighting the topics she will cover for attendees.

Overall, the market outlook remains uncertain, with mixed signals from various contributors on the future direction of stocks and gold. While some see signs of a potential rally in the coming months, others emphasize the importance of caution and risk management in the current volatile environment. Investors are advised to closely monitor market trends and analyze data-driven insights to make informed decisions in their investment strategies.