Inflation has been a major concern in recent years, with the COVID-19 pandemic exacerbating the issue due to supply chain disruptions and government stimulus packages. Commodity prices have seen a significant increase, with military conflicts in regions like Ukraine and the Middle East adding to the risk of further price hikes. Focusing on previous inflation cycles, Kenley Scott and William O’Neil + Company’s Sector Strategist, analyze the current inflation cycle to provide valuable insights.

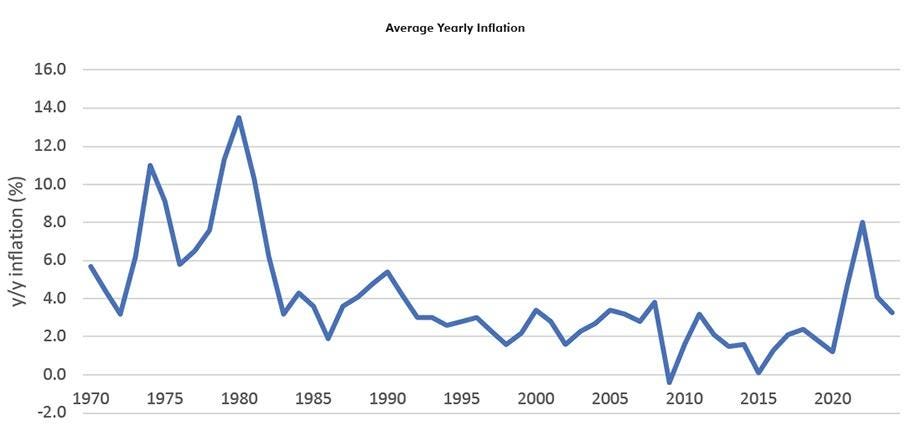

Historically, inflation has been relatively contained between zero to 4%, but since the COVID low, inflation has steadily increased to a high of eight percent in 2022. Currently, inflation sits at 3.3%, having ticked up from 3.1% y/y in January to 3.5% in March, despite a slight decline. Commodity prices have also started to rise again, with a strong correlation between commodity prices and US yields. Commodity sectors tend to outperform during periods of higher inflation, while the stock market performs better when inflation is on the decline.

Looking back at previous decades, periods with high inflation and high interest rates saw the stock market stay strong while energy and materials sectors underperformed. On the other hand, periods with higher commodity prices and outperformance in the energy and materials sectors, but lower inflation, saw the stock market remain strong. The current period has seen higher inflation than the previous 39 years, with the overall market performing better than commodity sectors. However, there is a possibility that commodity sectors may experience a “catch up” period if the US economy remains resilient.

O’Neil Global Advisors express concern about a return to much higher overall inflation, as it usually coincides with weak stock market performance. Rising commodity prices in oil, copper, gold, silver, and steel may not necessarily lead to double-digit inflation like in the 1970s, depending on various factors such as wages, supply chains, wars, and national trade policies. Despite this, there is a positive outlook on the technical and fundamental setups in commodity sectors, suggesting that we may be in the middle of an extended commodity cycle. The recommendation is to overweight commodity-related stocks relative to the overall market in the current climate.

In conclusion, the analysis of previous inflation cycles provides valuable insights into the current inflationary environment. The rise in commodity prices, combined with factors such as supply chain disruptions and ongoing military conflicts, presents challenges for policymakers and investors. While the stock market has performed well in the face of higher inflation, there is a possibility that commodity sectors may experience a period of outperformance in the coming months. Investors are advised to carefully monitor market trends and adjust their portfolios accordingly to navigate the changing economic landscape.