In 2010, a simplified description of the US budget called Federal Budget 101 was published and featured the fictitious Jones family to help readers better understand the government’s debt and deficit. Despite efforts to simplify the concept, the issue has only worsened over the years, prompting a revisit to the Jones family scenario in a new article titled A Reverse Mortgage on the Country. The latest analysis of the 2023 fiscal year Federal Budget provides a clearer perspective on the financial situation, with the US income at $4.44 trillion, federal budget at $6.13 trillion, new debt at $1.7 trillion, and national debt at $33.17 trillion.

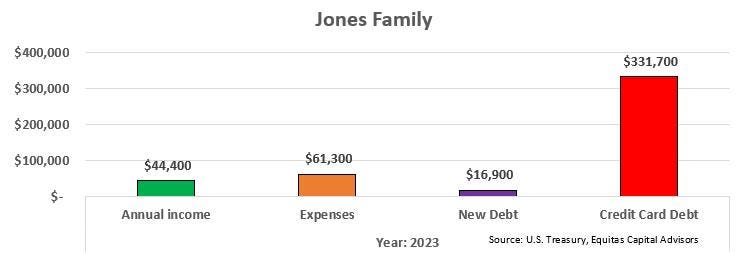

Comparing the federal budget numbers to the Jones family’s household budget, with eight zeros removed, highlights the dire situation. The Jones family, with an annual income of $44,400 and expenses of $61,300, is accumulating new debt of $16,900 and has a credit card debt of $331,700. The escalating debt levels coupled with deficit spending of 27.6% reflect a concerning financial scenario that continues to deteriorate year after year. The Jones family’s debt has significantly increased over the years, reaching unsustainable levels that pose a threat to their financial stability.

The impact of interest rates on the federal government’s debt is significant, with an average interest rate of 2.97% in 2023. As interest rates rise, the annual interest payments on the debt could potentially reach 40% of the government’s revenue. In comparison, the Jones family would face much higher interest rates on their debt, with potential annual interest payments amounting to 170% of their income. This would leave the family struggling to afford basic living expenses, highlighting the severity of their financial predicament.

The Jones family’s debt trajectory over the years reflects a lack of fiscal responsibility and a failure to address the growing debt burden. Despite being able to run a surplus in the past, the family has accumulated significant debt over the years, reaching unsustainable levels. The exponential growth of their debt is likened to a ticking time bomb, with potential adverse effects on their financial well-being.

The article underscores the importance of addressing the country’s debt levels, with total Debt-to-GDP ratio reaching 120%. Studies suggest that a debt ratio exceeding 77% could have a negative impact on economic growth, underscoring the need for measures to normalize debt levels. Lower interest rates could help narrow the deficit, but more comprehensive actions such as reducing federal spending or increasing revenue through taxes may be necessary to achieve a sustainable solution.

Equitas Capital Advisors, a company specializing in designing and delivering investment solutions, emphasizes the need for careful monitoring of the evolving financial landscape. With over 200 years of combined investment management consulting experience, the firm remains vigilant for any unexpected developments that may impact the economy and financial markets. As the country grapples with escalating debt levels, proactive measures are essential to steer the economy towards a more stable and sustainable path.