Student loan borrowers have until September 30 to take advantage of the federal Fresh Start program, which allows them to reverse their debt out of default and avoid consequences such as wage garnishment, lost tax refunds, or Social Security payments. The program is not a forgiveness program but offers a way for borrowers to get back on track with their student loans. Borrowers are encouraged to apply for Fresh Start as the debt will not disappear, and this program provides a way out for those who don’t have one.

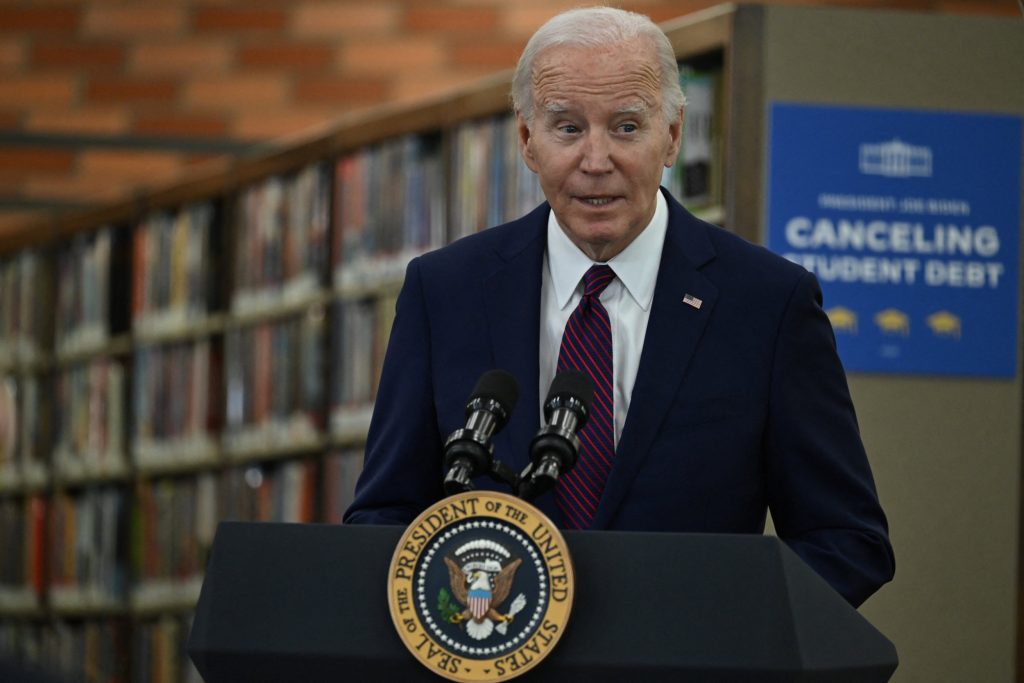

President Joe Biden recently announced $1.2 billion in student debt cancellation for almost 153,000 borrowers, highlighting the importance of addressing student loan issues. The Fresh Start program provides a special way for borrowers in default to bring their loans back into good standing before facing consequences like lost wages, by signing up for the program before the deadline. This opportunity is particularly significant for borrowers who were in default before the COVID-19 payment pause, as it offers a more straightforward and faster solution compared to other methods.

The Fresh Start program is seen as a golden opportunity by financial experts, as it provides an efficient way to address student loan defaults and opens doors to other repayment options. By instantly bringing loans current and allowing enrollment in plans like the SAVE repayment plan, borrowers have an easier path to managing their debt. Borrowers can apply for the Fresh Start program through their Federal Student Aid (FSA) account on studentaid.gov. Additionally, the Department of Education has approved several full forgiveness programs for student loan borrowers since President Biden took office, indicating a growing priority in addressing student loan issues.

The program also provides a way for borrowers to progress towards full student loan forgiveness, such as through Biden’s SAVE repayment plan that offers $0 per month payments. The Fresh Start program simplifies the process of bringing loans out of default and navigating repayment options, which can be complex and time-consuming through other methods. By taking advantage of Fresh Start, borrowers can avoid the stress of missed payments and financial consequences while working towards long-term solutions for managing their student loan debt.

For many borrowers who have faced challenges in making payments or experienced hardships, the Fresh Start program offers a lifeline to get back on track with their student loans. While the program is time-limited, it presents a valuable opportunity to address default status and seek alternative repayment options. As the deadline approaches, borrowers are encouraged to apply for the program and explore ways to manage their student loan debt effectively, taking advantage of available resources and support.