Mortgage rates, credit card rates, auto loan rates, and business loans with variable rates are expected to stay high as the Federal Reserve announced it will not cut interest rates until it sees a slowdown in consumer price increases. The average credit card interest rate in America is currently 24.66%, and it is unlikely to decrease anytime soon. Delinquencies and debt totals are also increasing, making it harder for consumers to transfer balances to 0% interest cards.

Savers have been benefiting from high yields on savings accounts and certificates of deposit due to the increased interest rates set by the Fed. However, some banks are starting to lower deposit rates in anticipation of the Fed eventually cutting rates. Online banks have been more aggressive in lowering rates compared to brick-and-mortar banks. Mortgage rates, influenced by the bond market, inflation, and other factors, recently rose above 7% for the first time since November, making it more expensive for consumers to buy homes.

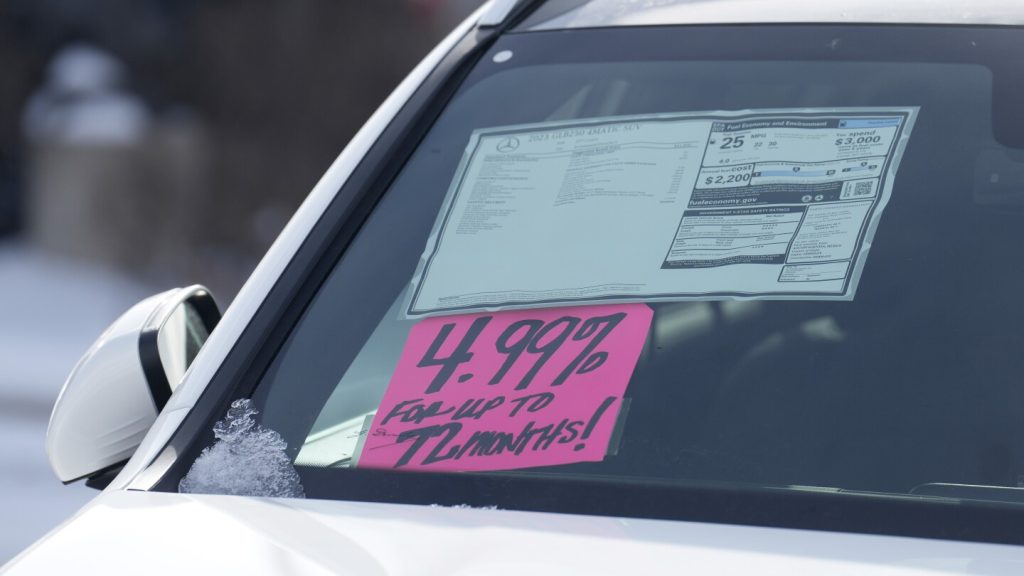

Despite the high mortgage rates, some economists believe it could still be a good time to buy a home, as timing the market is difficult. High shelter and rent costs have led to steep inflation in recent months, with renting being cheaper than buying a median-priced home in all 50 of the largest U.S. metro areas. Auto loans are also expected to remain expensive, with high interest rates and delinquency rates reaching a nearly thirty-year high. The average monthly car loan payment for new vehicles was $738 and $532 for used ones in the fourth quarter of 2023.

The Federal Reserve’s efforts to slow inflation have not progressed as quickly as desired, with inflation still above pre-pandemic levels in various sectors. The costs of services like rents, healthcare, restaurant meals, and auto insurance continue to grow, contributing to the overall inflation rate. Despite the Fed’s efforts, inflation remains a concern for the economy. It is important for consumers to be aware of the impact of high interest rates on borrowing and saving decisions in this economic climate.