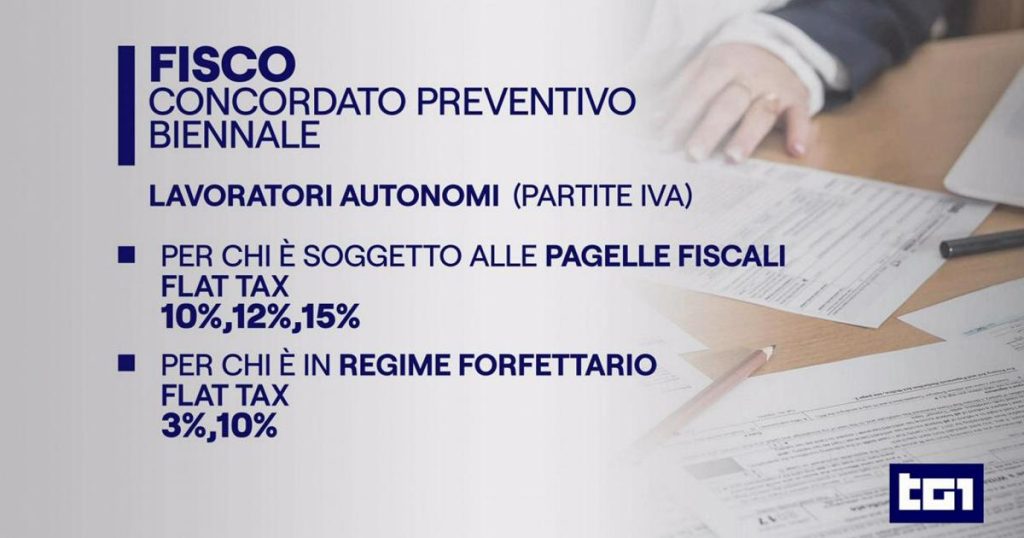

The new fiscal agreement known as the flat tax is being introduced to make it more convenient for self-employed individuals to reconcile with the tax authorities. Under this agreement, the tax rate on additional income to be declared is decreased to as low as ten percent. This development will likely benefit many self-employed individuals who will now find it easier to manage their tax obligations and ensure compliance with the law.

The introduction of the flat tax system marks a significant shift in the fiscal landscape, especially for self-employed individuals who typically face higher tax rates on their income. With this new system, the burden of paying taxes on additional income will be significantly reduced, providing a much-needed reprieve for many self-employed individuals. The lower tax rates under the flat tax system will likely encourage more compliance and help reduce tax evasion among this demographic.

The flat tax system is expected to streamline the tax filing process for self-employed individuals, making it easier for them to accurately report their income and pay the appropriate taxes. By simplifying the tax system and reducing the tax burden on additional income, the flat tax system will likely incentivize self-employed individuals to comply with tax regulations and avoid penalties for non-compliance. This, in turn, could lead to increased tax revenues for the government and a more efficient tax collection process.

The implementation of the flat tax system represents a significant step towards creating a more equitable and efficient tax system for self-employed individuals. By reducing the tax rates on additional income, the government aims to provide a more favorable environment for self-employed individuals to meet their tax obligations and contribute to the overall tax revenue. This move is likely to be welcomed by many self-employed individuals who have long struggled with high tax rates and complex tax regulations.

Overall, the introduction of the flat tax system is a positive development for self-employed individuals, as it offers a more simplified and fairer tax regime that encourages compliance and reduces the risk of tax evasion. The lower tax rates on additional income will likely ease the financial burden on self-employed individuals, making it easier for them to meet their tax obligations and avoid the penalties associated with non-compliance. This move is expected to lead to increased tax revenues for the government and a more efficient tax collection process, ultimately benefiting both the government and self-employed individuals alike.