Summarize this content to 2000 words in 6 paragraphs

At Skift, we recognize that corporate financial filings of public companies—including earnings-call transcripts, quarterly 10-Qs, and annual 10-Ks—provide a more detailed and many times unfiltered window into a travel company’s business priorities.

In this new series, we use AI analysis and expert editorial insight to dissect both the verbal discussions in earnings calls and the granular data buried in SEC filings. Our goal is to unearth the tech opportunities these documents reveal—whether that’s upcoming system upgrades, emerging RFPs, or digital transformations.

With this combined approach, we aim to equip travel-tech vendors, operators, and investors with actionable intelligence. This Skift’s series helps you stay ahead of the curve on where and how travel companies are looking to invest in fresh tech solutions.

We’re kicking off our coverage with Soho House, which recently reported its Q3 2024 earnings. As the year winds down, its timing stood out, but more importantly, Soho House explicitly highlighted tech-related transformations—specifically in the finance ERP domain. That makes Soho House the perfect case study to show how we use AI analysis to identify potential vendor opportunities from inside corporate calls and filings.

Soho House explicitly states they are replacing their finance ERP (Enterprise Resource Planning) software with “a new industry leading cloud-based system,” and have already hired a Chief Transformation Officer and outside consultants to manage the process. This is a clear signal that they are indeed in the market—and already deep in the process—of procuring/implementing new finance and back-of-house tech solutions.

Where Soho House explicitly and implicitly points to new tech or vendor solutions

Finance ERP Replacement

Quote (Thomas Allen, CFO):“We are making investments to try to replace our current finance enterprise resource planning or ERP software with a new industry leading cloud-based system… It will allow us to scale more cost effectively, which is important for a company that is in over 20 countries….”

Interpretation: Soho House is actively replacing its ERP with an “industry-leading” (hence likely third-party) cloud-based solution. This is a major vendor-related purchase/implementation, often requiring months (or longer) of scoping, vendor selection, data migration, and rollout. They have also hired a new Chief Transformation Officer to lead this effort—another sign they are serious about the tech upgrade.

Hiring Consultants for Implementation / Data Cleanup

Quote:“We have also hired consultants to support the company to create a comprehensive plan and assist with the review of our books to make sure the data that will go into the ERP system has been checked over.”

Interpretation: They are working with outside consulting partners—potentially including specialized ERP integrators or Big Four accounting/consulting firms—to ensure they clean up data and get the right design for the new system.

Deeper Finance & Accounting Tech Stack

Quote:“North America is our largest region… This has generally been a manual process, which is therefore more prone to error. We have been investing in this area to remediate these issues.”

Interpretation: Their present environment is manual and complex, indicating substantial opportunities for automation and better systems—likely to be done through new software rather than only in-house solutions.

Membership & CRM Enhancements

Status: Indirect references in the 10-Q; no direct RFP, but a big membership base.

Key Needs:

Single view of membership data across Soho House, Soho Friends, Soho Works, The Ned, etc.

Upsell/retention analytics, event management, mobile app integration.

Who Benefits: CRM or loyalty-solution vendors, data-analytics providers, marketing-tech integrators.

Front-End Digital Upgrades

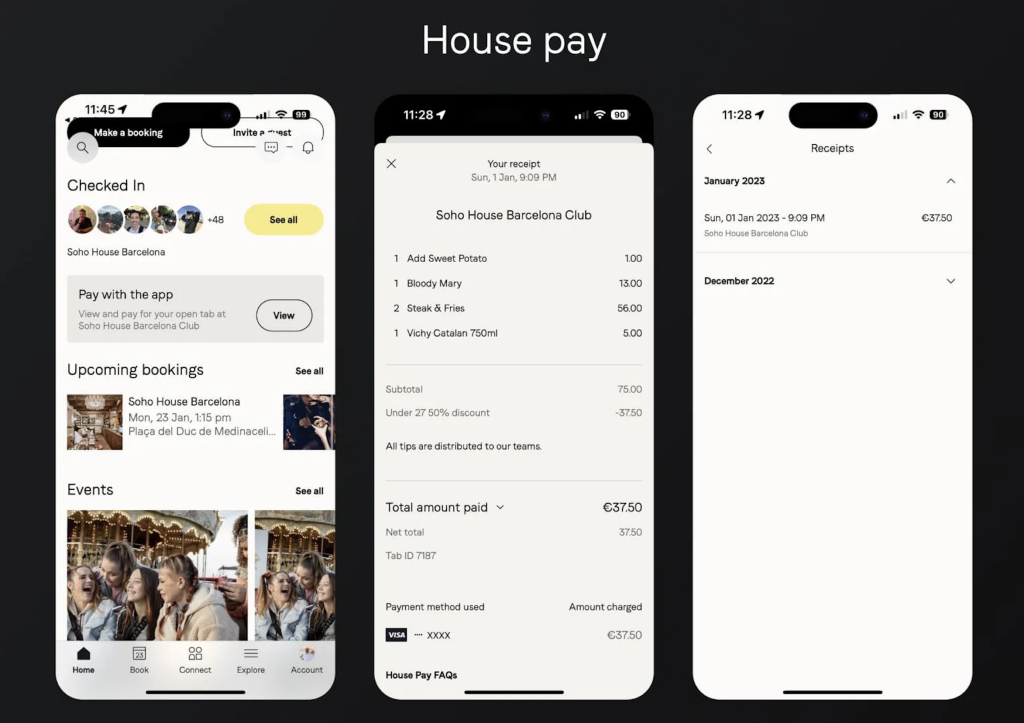

Status: The 10-Q underscores the importance of the Soho House App and website for booking, brand engagement, and membership services.

Key Needs:

Enhanced user experience for reservations, event signups, or content.

Personalization engines, location-based features, chat-based member services.

Who Benefits: App development studios, personalization tech, marketing automation vendors, AI-based recommendation providers.

Property Management & Guest Experience

Status: Not explicitly cited in the 10-Q or call as a priority upgrade, but expansions in hotels (e.g., The LINE, Saguaro, The Ned) and big membership volumes may necessitate robust PMS or POS solutions.

Key Needs:

Unified property management systems for both member and non-member bookings.

Integration with membership accounts, F&B, spa, and payments.

Who Benefits: Hospitality-tech providers offering PMS, POS, and integrated booking systems.

Bottom Line

The 10-Q reaffirms Soho House’s global footprint, membership-centric model, and digital ambitions—factors that increase the need for strong, integrated systems. Coupled with the earnings call’s explicit mention of a new ERP and consultant-led finance transformation, it’s clear Soho House is an active buyer of tech solutions for both back-of-house (finance, data integration) and potentially front-of-house (membership, app/website enhancements). Vendors specializing in multi-country hospitality, membership management, or enterprise finance software would do well to monitor these developments as Soho House’s transformation continues.