Summarize this content to 2000 words in 6 paragraphs

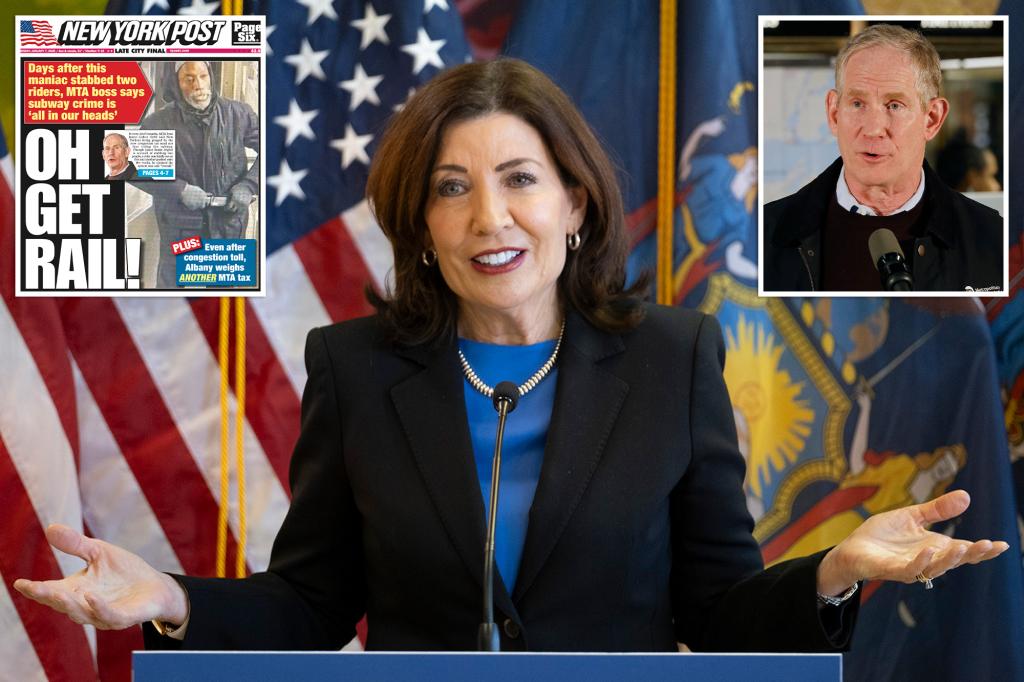

Gov. Kathy Hochul is considering hiking a dreaded tax on businesses to prop up the flailing Metropolitan Transportation Authority in a scramble to fill a whopping $33-billion budget hole, sources said — but the governor’s so far keeping her plans secret.

Hochul’s budget director has admitted fees and taxes will be needed to feed the MTA’s massive capital spending and that remains the reality despite the Sunday launch of the governor’s new hated — but cash-generating — $9 congestion toll.

The Democrat is again considering increasing the payroll mobility tax, which she had floated last summer to boost revenue source when she delayed the rollout of the congestion toll just then immediately resurrected it after the 2024 elections.

New Yorkers may soon end up getting squeezed by both the toll and the same tax increase that was floated as an alternative to the toll mere months ago, insiders and critics said.

“The MTA operates like the mob,” Councilman Joe Borelli (R-Staten Island) said. “The Congestion Capo, Janno Lieber, is ready to extort the public the minute after they start paying off the first debt. It’s an endless cycle.”

The MTA is desperate for an infusion of cash to fuel a Hochul-backed $68 billion capital plan and how to do that is front-and-center in the minds as state lawmakers return to Albany this week but sources said it’s possible the list of new fees and taxes may be decided in closed-door negotiations.

Hochul’s office has refused to say whether she’ll even release a proposal to make up the mammoth MTA funding gap, but sources said the governor is likely to take up a larger payroll tax on businesses after the mobility tax was just hiked in 2022. The new fees may go beyond just the five boroughs, experts said.

“The only thing certain is that this will not be a repeat of two years ago, when there was an increase in the payroll mobility tax exclusively imposed on New York City-based corporations,” said Kathy Wylde, CEO of the Partnership for New York City, a group repping big New York City businesses. “Any additional tax will need to be regional and broad-based.”

The payroll mobility tax charges businesses in the New York City metropolitan area based on the size of their overall payrolls. There are three tiers with larger firms paying a higher rate than small businesses.

Follow along with The Post’s coverage of Manhattan’s new congestion pricing

“Currently, business pays most of the 44% of MTA revenues that come from taxes,” Wylde, a pro congestion toll Hochul ally, told The Post Tuesday. “Whatever is enacted, MTA cost savings will have to be part of the package. Everyone will need to contribute.”

The payroll mobility tax is likely to face opposition from the state legislature which flatly rejected it when Hochul tried to use it during the congestion pricing pause last June.

The uncertainty had critics fuming in the early days of the new congestion pricing plan.

“Kathy Hochul is not solving the problem of inflation. She is making it worse through an endless extraction of hidden fees and taxes from working-class New Yorkers,” said Rep. Ritchie Torres (D-NY), who is eyeing a run for governor.

The payroll mobility tax applies to businesses in New York City, on Long Island and in some Hudson Valley suburbs.

Currently, New York City businesses with payrolls larger than $437,500 must pay 0.6% of that for the tax. Businesses outside of the five boroughs pay slightly less.

Albany increased the tax in 2022 to make up for a shortfall in operational funding at the MTA at the time – something Hochul touts as her having “saved the MTA.”

While it’s unclear just how much of the tax employers pass onto their employees in real terms, fiscal experts say it adds to an already dismal climate for businesses in the state.

“The more and more that we add taxes to businesses, there is a risk that we become less where they want to do business,” Ana Champeny, vice president for research at the Citizens Budget Commission told The Post.

Champeny said that Hochul and lawmakers need to consider more cost saving measures and other revenue.

“To just raise taxes on businesses in New York, which is what they did when they did the stabilization plan a few years back, is not the right approach,” she said.

Business groups are also firmly opposed to hiking the mobility tax.

“Governor Hochul has gifted the MTA free reign to grift NYC taxpayers into subsidizing their every irresponsible whim because, to them, New Yorkers are nothing but piggy banks to cushion a malfunctioning agency every time it inevitably falls in a financial hole,” Councilwoman Inna Vernikov told The Post.

Councilwoman Joanna Ariola (R-Queens) slammed the governor for digging “deeper into the pockets of hardworking New Yorkers.”

“The joke is that she is spewing a mantra about affordability when she is the one making our state and city less and less affordable to live in,” Ariola said. “I’d like to see the tolls and Hochul get the boot.”

Hochul is also entertaining the idea of not releasing a public plan for raising $33 billion at all, sources said as her office declined to say if she will include any proposal in her budget plan due Jan. 21.

On Monday, she passed the buck to the legislature and said the ball is “in their court.” That has sparked speculation in Albany, the menu of new revenue will be written in closed-door negotiations.

“I think that would be the worst outcome,” Champeny said.

“There should be a clear proposal that is made that is public that is discussed,” she added.

This is all happening under the backdrop of Hochul desperately clamoring for support by rolling out “affordability” proposals ahead of her state of the state address next week.

Hochul called for millions of dollars in grant funding to prop up and build new childcare centers at an announcement Tuesday before fleeing without taking questions from reporters.