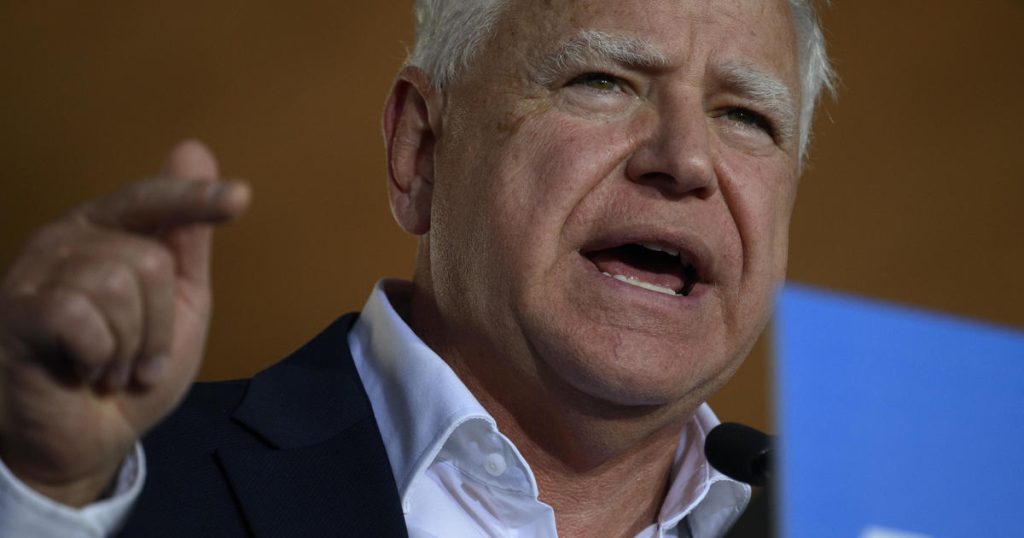

Minnesota Gov. Tim Walz will be facing off against Vice Presidential rival Sen. JD Vance in a debate to discuss issues such as taxes and the economy. With the economy being a critical issue in the upcoming November election, the share of voters who consider the economy as good has slightly increased, benefiting the Democratic ticket of Walz and Harris. Walz’s approach to economic issues can be seen through his actions as the governor of Minnesota, where he has enacted policies such as the largest state Child Tax Credit and free school meals for K-12 students, while increasing taxes on high earners.

Walz’s track record with taxes in Minnesota has been noted for making the state’s tax code more progressive, asking more from high-income individuals to fund social programs like free school lunch. His actions in Minnesota align with the plans put forth by the Harris-Walz national campaign, which include a more generous federal Child Tax Credit and increasing taxes on higher earners and corporations. Minnesota’s Child Tax Credit of $1,750 per child is the most generous in the U.S. and has been credited with helping reduce child poverty rates.

In contrast, Vance has proposed expanding the federal CTC to $5,000, although Republican lawmakers blocked a modest expansion earlier this year. Walz has also sought to help retirees by eliminating Minnesota income taxes on Social Security benefits for three-quarters of beneficiaries. His actions have been funded by raising taxes on higher-income households, unlike proposals from other politicians to lower taxes on corporations and high earners.

Minnesota’s economy has seen growth since Walz was elected in 2018, with a GDP expansion of about 5%. The state has recovered jobs lost during the pandemic and has median incomes higher than the national average. Minnesota also ranks highly for doing business, with several companies planning expansions or investments in the state. The state’s strong economy has generated enough tax revenue to provide surpluses in recent budget cycles, including a $17.6 billion surplus for 2023 that funded social programs like free school meals.

The upcoming debate between Walz and Vance is expected to focus on their ideas for addressing the rising cost of living and economic challenges facing families. Walz’s policies in Minnesota, such as the Child Tax Credit and tax cuts for retirees, highlight his approach to using tax revenue to fund social programs and support families in the state. Vance’s economic views, which include expanding the federal CTC and lowering taxes on corporations, will likely provide a contrast to Walz’s proposals during the debate on Tuesday.