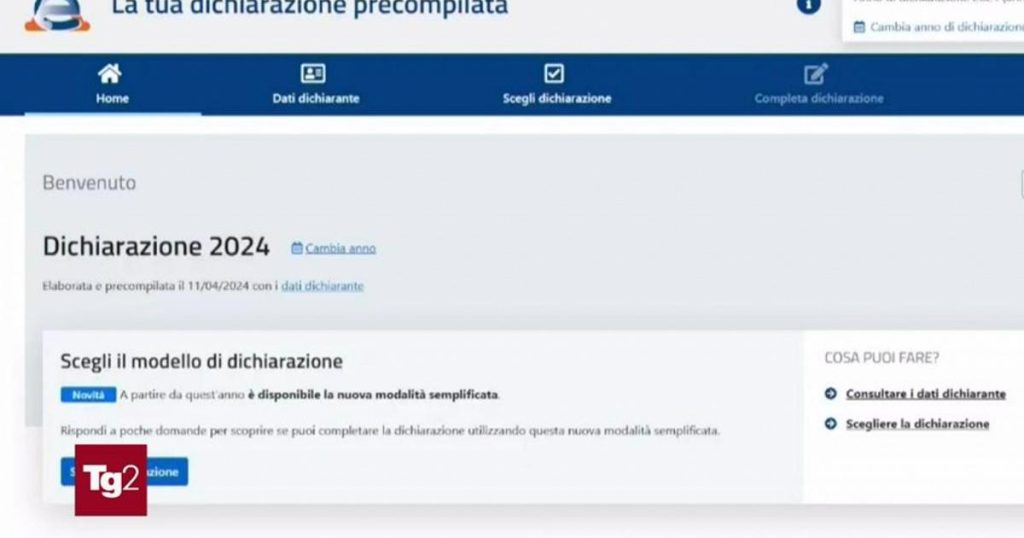

From the afternoon, the direct channel with the Revenue Agency is opened for the submission of the pre-filled income tax return for the 2023 tax period. This allows taxpayers to easily file their tax returns using the precompiled data provided by the agency. This streamlined process aims to simplify the tax filing process for individuals and ensure accuracy in reporting income and deductions.

By accessing the direct channel with the Revenue Agency, taxpayers can review and verify the pre-filled data before submitting their tax returns. This allows them to make any necessary corrections or additions to ensure that the information is accurate and up to date. The pre-filled income tax return includes information on income, deductions, and credits that have been reported to the agency by third parties, such as employers and financial institutions.

Overall, the pre-filled income tax return simplifies the tax filing process for individuals and reduces the likelihood of errors in reporting. By using the precompiled data provided by the agency, taxpayers can save time and effort in preparing and submitting their tax returns. This initiative is part of the government’s efforts to make the tax system more efficient and user-friendly for taxpayers.

It is important for taxpayers to carefully review the pre-filled data before submitting their tax returns to ensure that all information is accurate and complete. Any discrepancies or missing information should be addressed before finalizing the submission to avoid potential issues with the tax authorities. Taxpayers are encouraged to double-check their income, deductions, and credits to ensure that they are properly reported.

In conclusion, the opening of the direct channel with the Revenue Agency for the submission of the pre-filled income tax return for the 2023 tax period is a positive development for taxpayers. This streamlined process simplifies the tax filing process and reduces the likelihood of errors in reporting income and deductions. Taxpayers are advised to review and verify the pre-filled data before submitting their tax returns to ensure accuracy and completeness.