The key to building wealth for retirement is allowing your money to work for you through investing. By investing, you can take advantage of compounding returns, which has helped create millions of millionaires. While the idea of investing can be overwhelming, a simple and effective way to start is by investing in the S&P 500. This index includes 500 prominent U.S. companies and allows for easy diversification of investments.

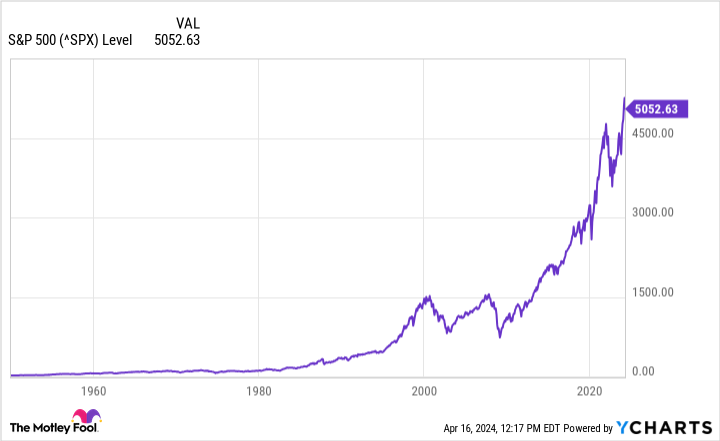

Investing in the S&P 500 means you are investing in some of the best companies in the world’s best economy. While the stock market can be volatile, history has shown that the market tends to rebound and grow over time. By following the Rule of 72, you can estimate how long it will take for your investments to double. On average, the S&P 500 has historically returned around 10% annually, leading to significant growth over time through compounding.

The fear of losses may prevent some investors from entering the market, but the S&P 500 can be seen as a relatively safe wealth-building tool. While there have been market crashes in the past, the market has always recovered and continued to grow. The key is to focus on the long-term trajectory of U.S. stocks, which are heavily reliant on consumer spending. While volatility may be present, it does not necessarily equate to risk.

Whether you are new to investing or have already started, it’s important to stay consistent and let your investments grow over time. By investing in an index fund that tracks the S&P 500, you can let your money work for you and benefit from the power of compounding. Starting early and letting your investments grow over time can lead to significant wealth accumulation in the long run.

In conclusion, investing in the stock market, particularly in the S&P 500, can be a powerful tool for building wealth for retirement. By allowing your investments to compound over time, you can benefit from the growth of some of the best companies in the U.S. economy. While there may be volatility in the market, history has shown that staying invested and focused on the long term can lead to significant wealth creation. It’s never too late to start investing and letting your money work for you towards a secure retirement.