Tax Day has arrived in the United States, with many last-minute filers racing to submit their 2023 income tax returns before the midnight deadline. IRS Commissioner Danny Werfel reported that over 100 million returns have already been received, with tens of millions more expected in the final days. Refunds totaling over $200 billion have already been paid out, with two in three filers expecting money back.

For those still working on their taxes, there are some key last-minute tips to keep in mind. Some Americans may have an extended filing deadline due to specific circumstances, such as living in a disaster area or observing certain holidays. However, for most people, the deadline is April 15. Those who cannot file on time can request an automatic six-month extension by filling out the necessary form, pushing their deadline to October 15. Without an extension, late filers will face penalties and interest on any outstanding balance owed to the IRS.

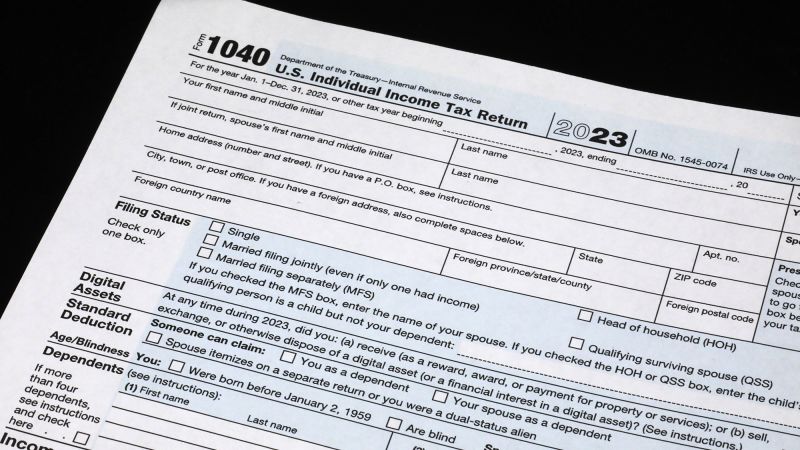

It is crucial to pay what you owe by the deadline, or at least make a partial payment if the full amount is not feasible. Failing to pay can result in additional penalties and interest accruing on the balance due. If needed, individuals can work out a payment plan with the IRS to reduce penalties and interest. Double-checking your return for accuracy is essential to avoid processing delays and potential issues with the IRS. This includes verifying personal information, answering digital asset questions, and ensuring the correct forms are filed, especially for cryptocurrency transactions.

Tax filers awaiting a refund can track its status using the IRS Where’s My Refund? tool online. The average refund amount in early April was $3,011, an increase from the previous year. The IRS has been efficient in processing refunds, with many people receiving them in just over a week. If you are due a refund and have not received it yet, tracking its status can provide insight into when to expect payment. Additionally, there are recommendations on how to utilize your refund effectively once received.

In conclusion, Tax Day presents a final opportunity for Americans to file their income tax returns or request extensions to avoid penalties. Making payments by the deadline, double-checking accuracy, and tracking refunds are essential steps to ensure a smooth tax-filing process. As millions of last-minute filers rush to meet the deadline, these tips can help navigate the process successfully and avoid potential pitfalls with the IRS.