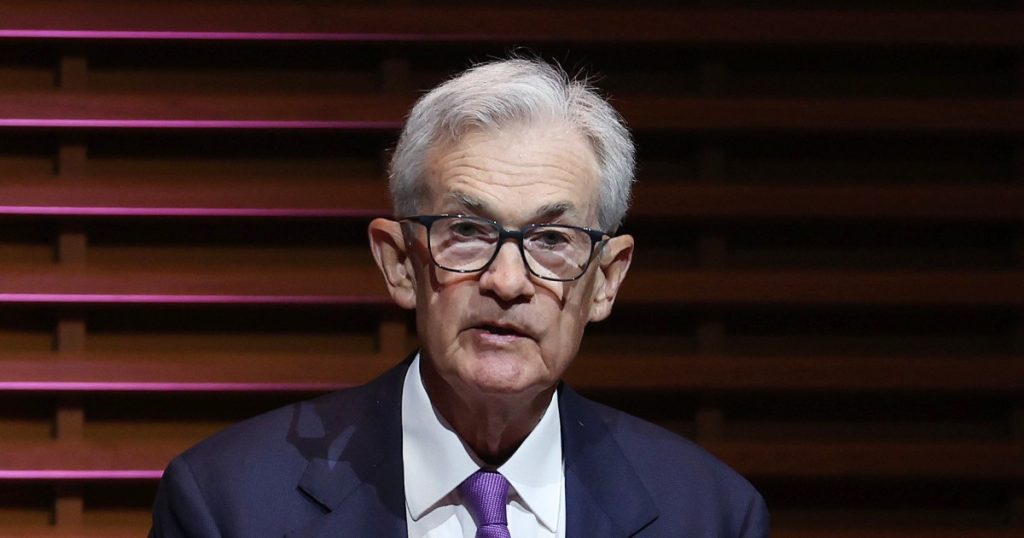

Federal Reserve Chair Jerome Powell recently addressed the state of the U.S. economy, noting that while growth and the labor market remain strong, inflation has not yet reached the central bank’s target of 2%. Powell stated that interest rate cuts are unlikely in the near future and that the current level of policy will likely remain in place until inflation gets closer to the desired goal. The Fed has maintained its benchmark interest rate in a target range between 5.25%-5.5% since July 2023, following 11 consecutive rate hikes beginning in 2022.

Powell emphasized that recent data have not provided greater confidence in achieving the inflation target, indicating that it may take longer than expected to reach that goal. He mentioned that the Fed’s preferred inflation gauge, the personal consumption expenditures price index, showed core inflation at 2.8% in February and has remained relatively stable over the past few months. The March consumer price index reading revealed inflation running at a 3.5% annual rate, higher than expected but lower than the peak in mid-2022. Powell highlighted the need for greater confidence in sustainable inflation movement before considering easing policy.

Following Powell’s remarks, Treasury yields rose, with the benchmark 2-year note briefly exceeding 5%. The benchmark 10-year yield also increased by 3 basis points. The S&P 500 initially fluctuated after his speech but eventually recovered. Financial markets had initially anticipated multiple rate cuts in 2024, but as data evolved, expectations shifted to fewer reductions, with traders now expecting one or two cuts, starting in September. The latest FOMC update in March suggested three cuts this year, but policymakers have emphasized the data-dependent nature of policy decisions.

Despite the strong growth and labor market conditions, Powell reiterated the importance of achieving the 2% inflation target before considering any policy adjustments. He acknowledged that recent data have not provided the necessary confidence in reaching the desired level of inflation and suggested that it may take longer than anticipated. Powell indicated that the Fed is prepared to maintain the current level of policy restrictions for as long as needed to handle the risks facing the economy. Financial markets have adjusted their expectations for rate cuts this year, with a shift from initial projections of multiple cuts to a more cautious approach based on evolving data.