Ambuja Cement, led by billionaire Gautam Adani, has agreed to purchase Penna Cement Industries for $1.2 billion, aiming to boost its production capacity in the midst of a construction boom in India. CEO Ajay Kapur hailed the acquisition as a significant milestone in Ambuja Cement’s growth journey, positioning the company as a key player in the cement industry in south India and beyond. The move will increase Ambuja’s annual production capacity by 14 million tonnes to about 89 million tonnes, bringing it closer to its target of 140 million tonnes by 2028 and narrowing the gap with Ultratech Cement, the largest cement manufacturer in India.

The strategic advantages of Penna Cement, including its favorable location and abundant limestone reserves, were highlighted by Ambuja. With Penna currently producing 10 million tonnes annually and expanding with two new plants, Ambuja will gain access to eastern and southern India, as well as an entry point to Sri Lanka via sea routes. The acquisition will also help Ambuja solidify its position as a pan-India leader in the cement industry, positioning the company for further growth and expansion in the coming years.

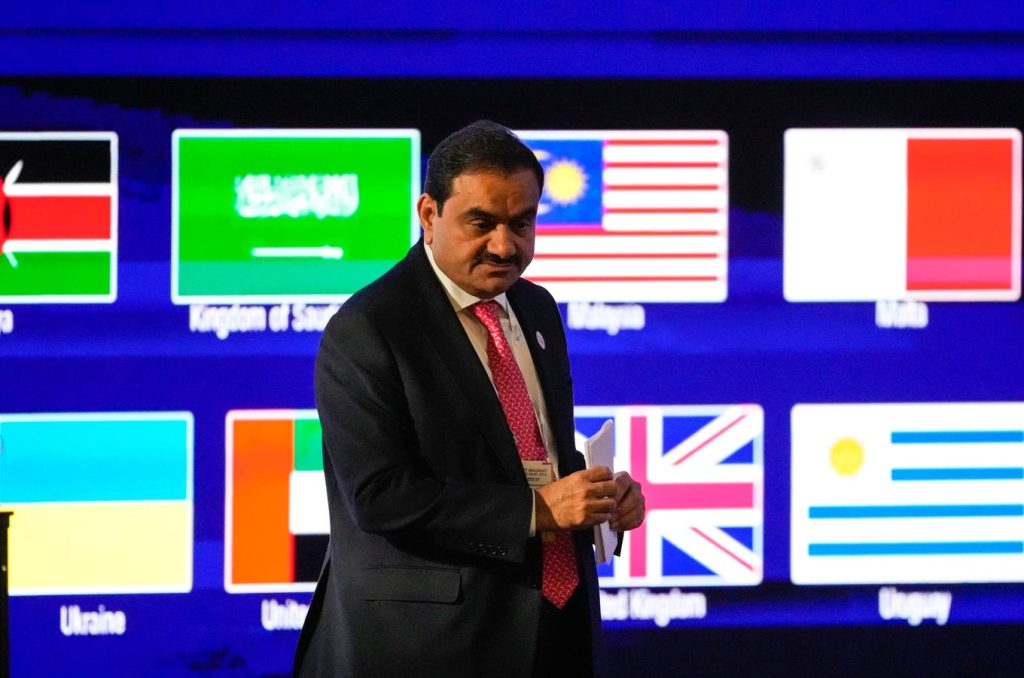

The Adani Group, under the leadership of Gautam Adani, has been increasing its investments in the cement sector as part of Prime Minister Narendra Modi’s infrastructure development and housing initiatives. In 2022, the group acquired Ambuja and ACC from Holcim for $10.5 billion, followed by the purchase of Sanghi Industries for $202 million. With a net worth of $68 billion, Adani is the second wealthiest person in India and oversees a diversified business empire that includes airports, mining, ports, and power generation in addition to cement.

The acquisition of Penna Cement by Ambuja Cement will help strengthen the group’s presence in south India and support its future expansion plans. The additional production capacity and access to new markets will position Ambuja for continued growth and success in the competitive cement industry. By leveraging Penna’s existing infrastructure and resources, Ambuja aims to enhance its market share and solidify its position as a leading player in the Indian cement market, under the leadership of CEO Ajay Kapur and the backing of Gautam Adani’s Adani Group.

As India’s economy continues to grow and demand for cement increases, Ambuja Cement’s acquisition of Penna Cement comes at a strategic time. The deal is expected to enhance Ambuja’s capabilities and market reach, positioning the company for further growth and expansion. With Ambuja’s ambitious targets for production capacity and market leadership, the acquisition of Penna Cement represents a significant step forward in the company’s growth journey and its efforts to become a key player in the Indian cement industry.