3G Capital, co-founded by Alexandre Behring along with Jorge Paulo Lemann, Carlos “Beto” Sicupira, and Marcel Herrmann Telles, has made billions in various industries such as banking, Brazilian beer, and burgers. Their latest venture is the acquisition of Dutch window blinds and coverings maker Hunter Douglas for $7.1 billion in February 2022. Behring, who spearfishes alongside his billionaire co-founders, applies the same skill set of recognizing opportunities quickly to his investing career. 3G, with $14 billion in assets under management, is unique in that it has only made a small number of investments in its 20-year history and is backed mostly by the partners’ own capital.

The firm’s first successful investment was the acquisition of Burger King in 2010, which has since turned into a 28-fold return for 3G, amounting to $20 billion in gains after including dividends. Despite some less successful ventures such as Heinz and Kraft, 3G’s latest acquisition of Hunter Douglas is shaping up to be another windfall. Behring, known for his calm and patient approach to investing, has turned down offers for a minority stake that would have resulted in a significant return. The firm’s concentrated investing approach has proven successful in the past, with a focus on making big checks for themselves and their close partners.

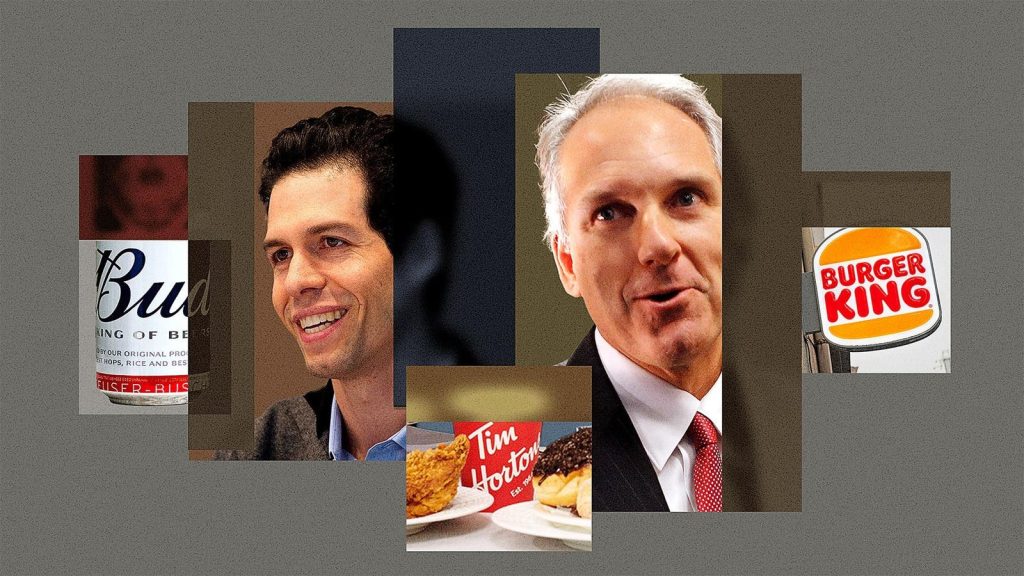

3G Capital was founded in 2004 by Behring, Lemann, Sicupira, and Telles, who collectively have an estimated $43 billion in wealth. The firm was born out of Lemann’s success in building Banco Garantia into Brazil’s largest investment bank before selling it to Credit Suisse in 1998. Behring, who met Sicupira while a student at Harvard Business School, later became the CEO of America Latina Logistica and restored it to profitability before starting 3G in 2004. The firm’s early success in the beer industry led to the buyout of Anheuser-Busch and the formation of AB InBev, the largest brewer in the world.

After achieving success in the beer industry, 3G turned its attention to the fast-food sector with the acquisition of Burger King in 2010. Behring and his team quickly turned the business around by cutting costs, expanding globally, and re-levering their gains into the acquisition of Tim Hortons and Popeyes. Their focus now is on Hunter Douglas, where they see potential for growth through operational efficiencies and global expansion. Despite their success, 3G is staying tight-lipped about their next big platform acquisition, maintaining their patient and methodical approach to investing.

The acquisition of Hunter Douglas represents a departure from 3G’s previous investments in food and beverage companies, but Behring and his team see parallels in the business as a dominant player in its category. By applying the same strategies that worked for Burger King, such as improving efficiencies and generating organic growth, they are confident in the potential for Hunter Douglas to become a global leader in window coverings. As they patiently build up their latest acquisition, 3G remains committed to their proven approach of finding great businesses, building strong ownership teams, and generating growth through both operational improvements and strategic acquisitions.

As 3G Capital continues to grow its portfolio and look for new investment opportunities, Behring and his partners are staying true to their approach of focusing on long-term value creation. With their track record of successful investments and their patient, methodical approach to building businesses, 3G is poised for continued success in the future. While they may not divulge their next big move just yet, one thing is clear: 3G Capital is a force to be reckoned with in the world of investing.