Government figures show that it now costs over $300,000 to raise a child from birth to age 18, making the federal child tax credit an important tool for parents to save money. Both the Harris and Trump campaigns are proposing larger versions of the tax break to further assist families with children. The child tax credit was first implemented in 1997 as a way to provide financial relief to parents, and has since become a key element in helping families manage the costs of raising children.

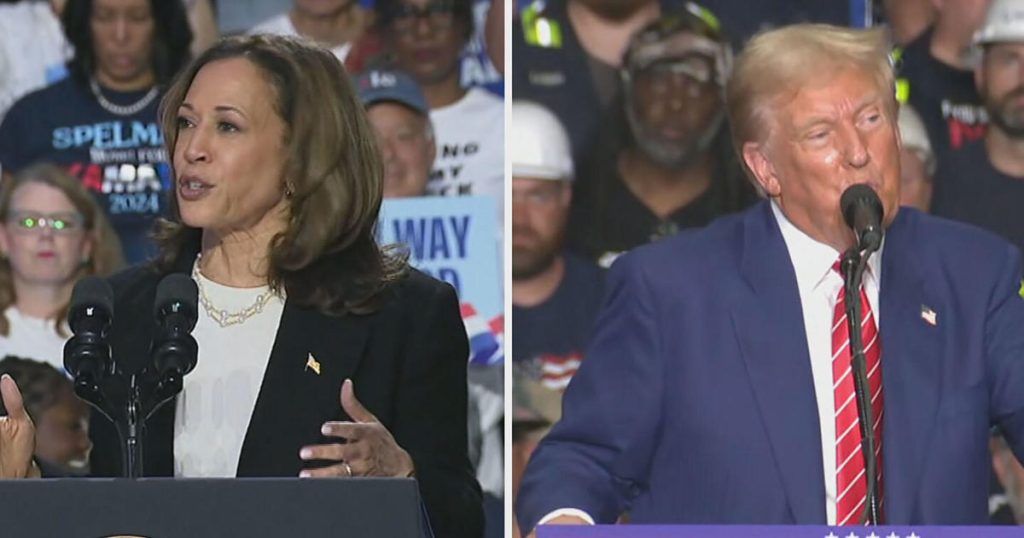

Senator Kamala Harris and President Donald Trump are both advocating for an increase in the child tax credit to provide more financial support to families with children. Harris has proposed a $3,000 credit for families making up to $125,000, while Trump has suggested a $1,000 increase from the current credit amount. Both candidates believe that raising the child tax credit will help alleviate some of the financial burden faced by parents raising children in the United States.

The cost of raising a child has continued to rise over the years, making it increasingly difficult for families to cover expenses associated with child-rearing. The child tax credit has become a vital resource for parents looking to save money and manage the costs of raising a family. With the proposed increases in the tax credit by both the Harris and Trump campaigns, families would receive additional financial support to help offset the high costs associated with raising children.

The child tax credit has been a valuable tool for parents since its inception in 1997, providing financial relief to families with children. Now, with the proposed expansions of the tax credit by both the Harris and Trump campaigns, families will have access to even more financial support to assist with the expenses of raising children. The rising costs of child-rearing make it essential for families to have access to financial assistance, and the child tax credit is one way in which the government can help alleviate some of the financial burden faced by parents.

Both Senator Kamala Harris and President Donald Trump are prioritizing the needs of families with children by advocating for an increase in the child tax credit. Harris’s proposal of a $3,000 credit for families making up to $125,000 and Trump’s suggestion of a $1,000 increase reflect a shared commitment to providing financial support to families. By expanding the child tax credit, both candidates hope to make it easier for parents to meet the growing costs associated with raising children in today’s economy.

In conclusion, the proposed increases in the child tax credit by both the Harris and Trump campaigns reflect a recognition of the financial challenges faced by families with children. Parents are increasingly struggling to cover the rising costs of child-rearing, and the child tax credit has become an important resource for many families. By expanding the tax credit, both candidates are aiming to provide additional financial support to families and help alleviate some of the financial burden associated with raising children.