The article discusses the issue of tax increases in France, focusing on how former Presidents Nicolas Sarkozy and Emmanuel Macron have both made promises to not raise taxes, despite facing pressure to do so. Sarkozy’s government considered repealing the “tax shield” measure, a hallmark of his presidency, due to the financial crisis’s impact on public accounts. However, he ultimately abandoned the idea. Macron, now facing financial challenges due to two successive crises and over 100 billion euros in tax cuts, continues to prioritize tax stability, with Prime Minister Gabriel Attal emphasizing the importance of not increasing taxes on the middle class or on businesses that create jobs.

The article questions whether these tax policies can be maintained when public finances are deteriorating, and when politically sensitive reforms are necessary to generate savings. Some experts, such as author Alain Minc, argue that tax increases are urgently needed to avoid further cuts in government spending that could harm economic growth and have negative social and political effects. Minc suggests raising VAT and income taxes on the wealthy, while leaving capital taxation untouched. The debate over tax policy is also occurring within Macron’s majority party, with figures like Yaël Braun-Pivet and Sylvain Maillard openly discussing the possibility of tax increases.

Braun-Pivet has expressed support for considering new revenue sources, including taxing excess profits in large companies and stock buybacks. She points to the substantial profits, dividends, and stock repurchases by CAC 40 companies in 2023 as evidence that some businesses could afford to contribute more through taxation. The current debate within Macron’s party signals a growing awareness of the need to address the government’s financial challenges and the potential necessity of implementing tax increases. Despite Macron’s previous reluctance to raise taxes, pressure from within his own party may force a reconsideration of this stance.

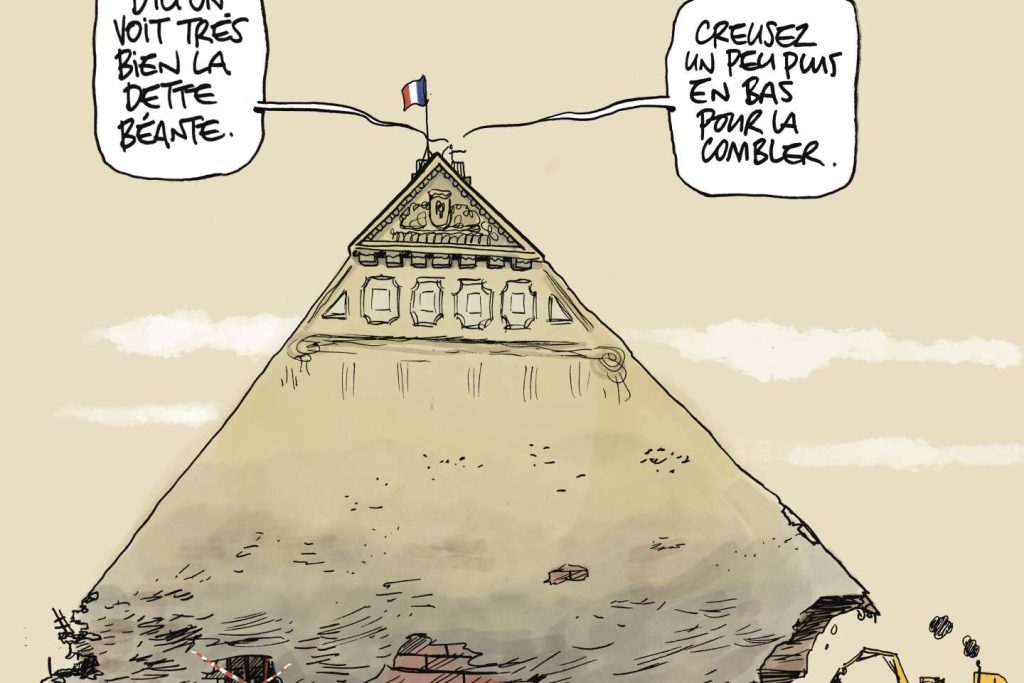

The prospect of implementing tax increases poses a political dilemma for Macron, who has prided himself on maintaining tax stability. The French President will need to balance the need to address the growing budget deficit and mounting debt with his commitment to not burdening the middle class with additional taxes. The decision on tax policy will have significant implications for the government’s economic strategy and its ability to fund public services and stimulate growth. Macron’s handling of the tax debate will shape his administration’s legacy and set the tone for future fiscal policy in France.

In conclusion, the debate over tax policy in France reflects the broader challenge faced by governments worldwide in managing public finances during periods of economic uncertainty. Macron’s previous stance on avoiding tax increases is being questioned as the country grapples with mounting debt and deficits. The discussion within Macron’s party about the possibility of tax increases indicates a growing realization of the need for revenue-raising measures to address these financial challenges. How Macron navigates this debate and implements tax policy will be a crucial test of his leadership and his ability to steer France through its current economic difficulties.