Boeing factory workers have been on strike for six weeks, with their main demand being the restoration of their pensions. The freeze on Boeing’s traditional pension plan was part of concessions made by the union a decade ago to keep production in Seattle. The latest contract offer from Boeing included a wage increase but did not address pension benefits. The rejection of this offer by 64% of union members has escalated the financial challenges for Boeing, already deep in debt and losing billions in revenue due to the strike.

Traditional pensions provide retirees with a set monthly income based on years of service and former salary. However, most workplaces have shifted to retirement savings accounts like 401(k) plans in recent decades. This shift was driven by the financial risks and difficulties associated with guaranteeing pension payments. While this trend is widespread, Boeing workers are fighting to reinstate their pension plan, despite the industry-wide move towards defined contribution plans that place retirement risks on employees.

Boeing’s decision to freeze its pension plan was part of a 2013 agreement to keep production in Washington state. The company contributed to retirement accounts for workers and froze pensions for new hires and certain existing employees. This move was motivated by the need to curb long-term pension liabilities and ensure competitiveness. Reinstating the pension plan now would come at a significant cost to Boeing, estimated at over $1.6 billion per year, according to analysts.

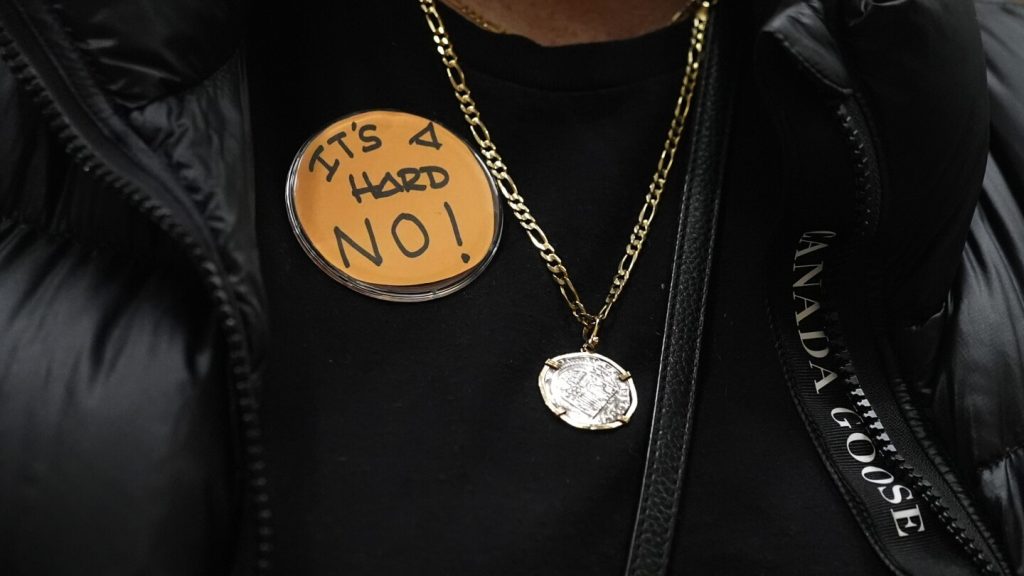

Boeing has maintained its stance against reinstating the pension plan, citing the high costs and industry trends towards defined contribution plans. While the company has raised its wage offer during negotiations, it remains firm on the pension issue. The rejection of the latest contract offer by union members signals a continued standoff between Boeing and its workers. The pressure is mounting on new CEO Kelly Ortberg to find a resolution, as the strike has led to significant financial losses for the company.

Restoring a frozen pension plan is uncommon in the corporate world, with only a few companies, like IBM, making such a move. IBM’s decision was driven by financial factors, as the plan had become overfunded after being frozen. While pressure is mounting on Boeing to reconsider its stance on pensions, the company faces significant financial implications if it were to reinstate the plan. The ongoing strike is causing daily losses for Boeing, making a quick resolution desirable for both parties.

As the strike continues, Boeing is facing increasing financial strain and pressure to reach a resolution. Analysts estimate that the company is losing millions of dollars per day due to the strike and layoffs announced by the CEO. The potential cost of a prolonged strike could reach billions, highlighting the urgency for Boeing to improve its offer and end the labor dispute. The future negotiations between Boeing and the union will likely focus on finding a solution that addresses the workers’ demands while also being financially viable for the company.