Seattle-based AI startup Wokelo recently secured $4 million in funding to further develop its technology, which generates detailed due diligence reports for corporate acquisitions, investments, and strategic decisions. The seed round investors include Array Ventures, Geek Ventures, KPMG Ventures, Rebellion Ventures, Ahead VC, and Perpetual Venture Capital. Co-founded in 2022 by former management consultants Siddhant Masson and Saswat Nanda, Wokelo now has 13 employees and over 35 customers, including private equity firms, venture capital firms, corporate development teams, investment banks, and management consulting firms.

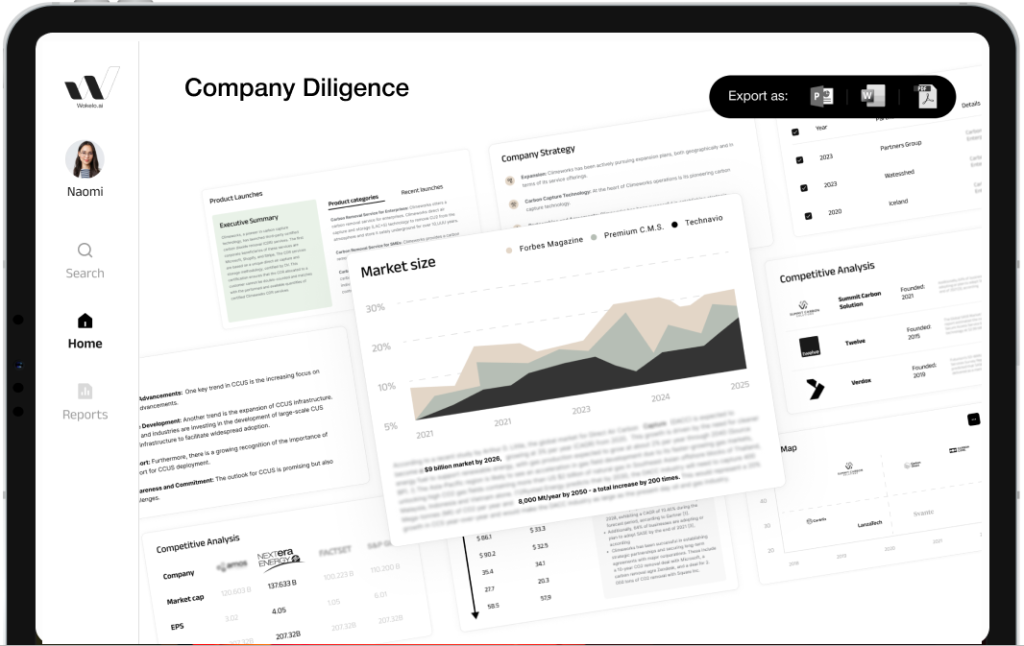

Wokelo aims to streamline the due diligence process by leveraging AI technology to automate data collection and analysis, allowing users to focus on high-level analysis and human expertise. The platform aggregates data from various sources such as news sources, financial filings, research journals, and more. It then generates comprehensive analyses that include company overviews, product insights, recent news analysis, industry landscapes, sector reports, and competitive analysis. Wokelo also offers additional features such as a secure data room for file uploads, a PowerPoint generator, and a Q&A chat function for further research.

Although Wokelo has made a name for itself in the private markets due diligence space, there are other companies offering similar AI solutions for due diligence and research. These include Ansaranda, Thomson Reuters, AlphaSense, and PitchBook. Wokelo’s seed round also included a minority equity investment from KPMG LLP, a global audit, tax, and advisory firm. KPMG’s deal advisory team is using Wokelo to expedite the due diligence and research process, aligning with their belief in Wokelo’s approach.

With the newly secured funding, Wokelo plans to invest in product development to enhance its capabilities and use cases, as well as expand its sales and support teams for business growth and customer support. Despite not having a marketing strategy in place, Wokelo has seen growth based on inbound interest. The company has raised a total of $5.5 million in funding, including an earlier pre-seed round, and is on track towards profitability. Co-founder Masson expressed confidence in building a financially sustainable business, with the name “Wokelo” symbolizing the future of work.

The investment in Wokelo by KPMG was highlighted as a strategic move to leverage cutting-edge technologies like AI to provide value to clients in the dealmaking process. KPMG’s commitment to harnessing technologies that drive tangible value for clients was emphasized by Andrew Matuszak, the managing director of KPMG Ventures. Carole Streicher, who leads KPMG’s U.S. Deal Advisory and Strategy Service Group, noted that AI is enhancing their approach to dealmaking by swiftly identifying new sources of value for clients. This aligns with the findings of KPMG’s 2024 M&A mid-year survey, where 42% of dealmakers reported using generative AI in the dealmaking process.

Overall, Wokelo’s innovative AI technology for due diligence reports has gained traction in the corporate acquisitions and investment space, with a growing customer base and strategic investments from notable firms like KPMG. The company’s commitment to product development, customer support, and sustainable growth positions it as a key player in transforming the future of work through AI-driven solutions for high-stakes decision-making processes.