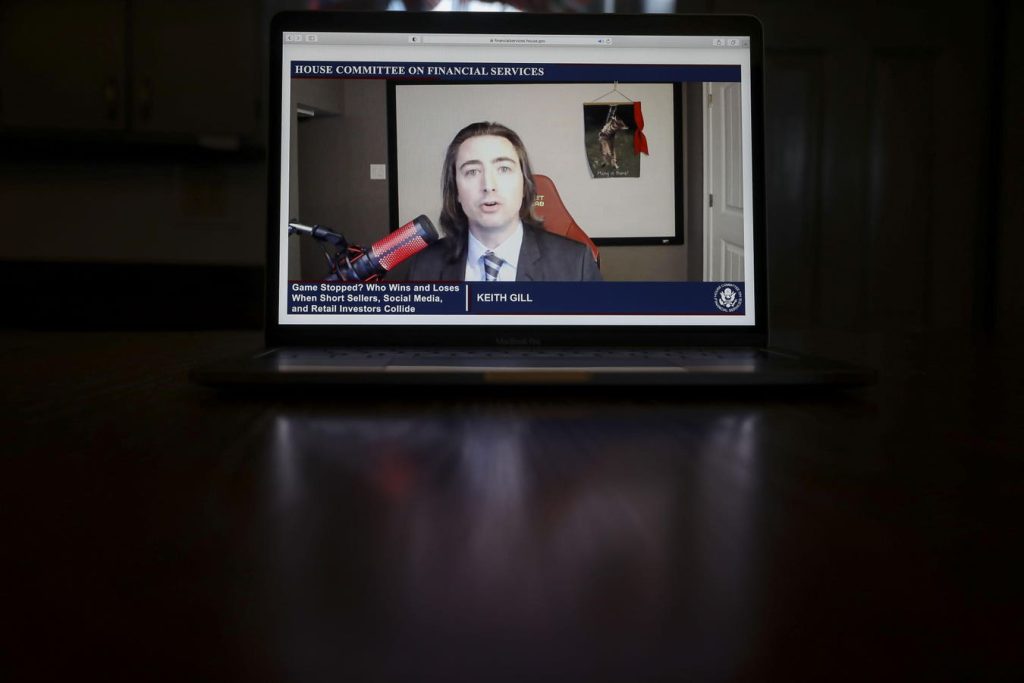

Keith Gill, also known as “Roaring Kitty,” has made a return to the spotlight, sparking questions about his influence on GameStop’s stock price. Gill, who gained fame during the GameStop frenzy of 2021, had kept a low profile after his testimony before Congress. However, a recent tweet from him caused GameStop’s stock to soar, leading to speculation about his motives and financial standing.

Gill’s cryptic tweets and Reddit posts have left followers trying to decipher his intentions. Some have questioned whether he is indirectly manipulating the market by not explicitly mentioning GameStop in his communications. Securities lawyers have differing opinions on whether Gill has violated any rules that could be considered market manipulation. Some argue that his actions do not meet the criteria for market manipulation, while others see potential grey areas.

The Securities and Exchange Commission (SEC) may come in to scrutinize Gill’s recent social media activity, especially as GameStop’s stock price tripled following his tweets. The SEC typically looks unfavorably upon actions that disrupt the normal functioning of securities markets, potentially prompting them to investigate Gill’s role in the stock surge. E*Trade, where Gill has an account, has reportedly started their own review of his activities, citing concerns of potential stock manipulation.

There is also curiosity surrounding how Gill funded his $180 million bet on GameStop stock and options. Some speculate that he might have made a fortune on short-dated options trades in May and reinvested the profits into GameStop in June. Others suggest he may have invested in other high-performing stocks, such as Nvidia, which has seen significant growth since 2021. Gill’s net worth at the peak of the GameStop frenzy was significantly lower than what would be needed to make such large investments.

As the SEC and other entities review Gill’s recent activities, the full implications of his tweets and investments remain to be seen. While some believe his actions may warrant further investigation, others argue that it may be challenging to prove any wrongdoing on Gill’s part. With his influence on GameStop’s stock price and the questions surrounding his financial transactions, Keith Gill’s return has once again ignited interest in the world of meme stocks and online investing.