Warren Buffett, the billionaire investor and CEO of Berkshire Hathaway, recently revealed that he sold more than 389 million Apple shares during the second quarter. Despite the sale, Berkshire still holds 400 million shares of Apple, making it the conglomerate’s largest stock position. In addition to Apple, Buffett has been trimming investments in companies like Bank of America, Chevron, Capital One, Floor & Decor Holdings, T-Mobile, and Louisiana Pacific. Berkshire also unloaded its nearly $1 billion Snowflake investment.

Due to these selling activities, Berkshire’s cash reserves have reached a record level of $277 billion. However, Buffett made some new investments during the quarter, including sinking more money into the insurer Chubb and oil producer Occidental Petroleum. He also revealed smaller new investments in aerospace parts maker Heico Corp. and cosmetics retailer Ulta Beauty. The quarterly filings do not specify which moves were made by Buffett himself and which were made by other investment managers at Berkshire, but Buffett usually handles the biggest investments worth over $1 billion.

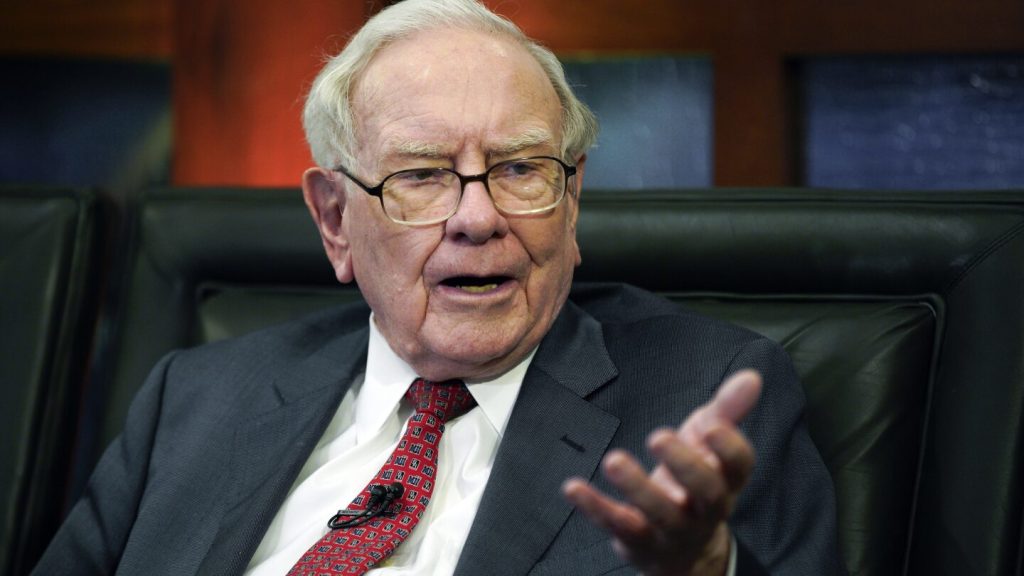

Investors closely follow Buffett’s actions because of his successful track record over the decades. Berkshire Hathaway not only has a significant stock portfolio but also owns major insurers like Geico, one of the nation’s largest railroads in BNSF, and a range of utilities, manufacturing, and retail companies. Some well-known brands under Berkshire’s ownership include Dairy Queen, Helzberg Diamonds, and NetJets. Buffett’s investments and decisions are closely watched in the financial world due to his past successes and the size and scope of Berkshire’s holdings.

Buffett’s decision to sell a significant portion of Apple shares may raise questions among investors about his outlook on the technology giant’s future performance. Apple has been one of Berkshire’s most successful investments in recent years, with the stock price consistently rising. However, Buffett’s selling activity could indicate a shift in his investment strategy or concerns about Apple’s growth prospects. Other investments that Berkshire increased during the quarter, such as Chubb and Occidental Petroleum, may offer clues about Buffett’s current investment priorities and areas of interest.

The $277 billion in cash reserves held by Berkshire could also signal that Buffett sees limited investment opportunities in the current market environment. With global economic uncertainty and stock market volatility, holding a substantial cash position may provide Berkshire with flexibility to capitalize on future opportunities and weather potential market downturns. Buffett’s continued focus on value investing and long-term growth may guide his decision-making as he navigates the ever-changing investment landscape. Ultimately, investors will continue to monitor Buffett’s moves and portfolio adjustments for insights into his strategies and outlook on the market.