In 2023, the public deficit in France exceeded government predictions, reaching 5.5% of the Gross Domestic Product (GDP), according to the National Institute of Statistics and Economic Studies (INSEE). This figure was higher than the 4.9% forecasted by the government in the most recent budget law, adopted less than three months prior. Pierre Moscovici, the First President of the Court of Auditors, criticized the government for being too optimistic and underestimating the deficit by 17 billion euros.

The public deficit represents the difference between government revenues (taxes, social contributions, property sales, etc.) and expenses (allocations to administrations, social benefits, etc.). In recent French history, deficits have only exceeded the 2023 level three times: in 1993 during the European Monetary System crisis (6.4%), in 2009 and 2010 after the subprime crisis (7.4% and 7.1%), and in 2020 and 2021 during the COVID-19 pandemic (8.9% and 6.6%). With a deficit of 5.5% of the GDP, France is moving further away from the 3% target set by European treaties. Pierre Moscovici noted this deviation, having dealt with significant deficits himself during his time as Minister of Finance under François Hollande (2012-2014).

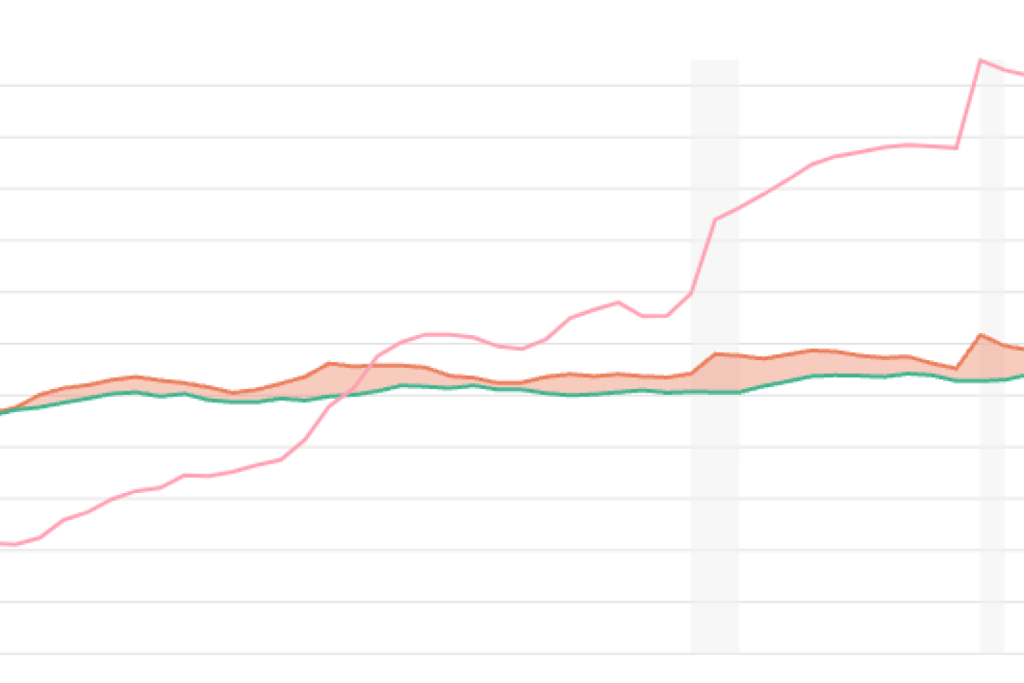

It is important to distinguish between the deficit and the debt. The state borrows money every year to fund services that cannot be covered by its revenues alone. While revenues as a percentage of the GDP remain relatively stable over time, expenses consistently surpass them. This accumulation of deficits has led to a significant increase in the national debt, which has risen from 20% of the GDP in 1980 to over 110% today, particularly due to the COVID-19 pandemic and the generous budgetary policies introduced. This high debt level results in substantial interest payments that need to be repaid, known as the debt service, which becomes heavier when interest rates are high. In 2022, France’s debt repayment budget amounted to 53.2 billion euros, exceeding the budgets of both the Interior and Justice ministries combined, and 60% higher than in 2020.

The government’s failure to meet deficit targets has repercussions for the country’s economic stability and compliance with European Union regulations. Excessive deficits can undermine investor confidence, lead to higher borrowing costs, and jeopardize economic growth. The mounting debt also restricts the government’s ability to allocate funds to essential services and investments, potentially affecting the quality of public services and infrastructure. Addressing the deficit issue requires a combination of fiscal discipline, efficient management of public finances, and strategic investments to stimulate growth and reduce reliance on debt.

In order to tackle the deficit and reduce the debt burden, policymakers may need to implement measures such as increasing tax revenues, controlling public spending, and promoting economic growth through targeted investments. This requires careful planning, coordination between government departments, and collaboration with international partners to ensure a sustainable recovery. Transparency and accountability are essential in managing public finances, as well as engaging with the public to explain the rationale behind economic decisions and garner support for necessary reforms. By addressing the root causes of deficits and debt accumulation, France can work towards a healthier fiscal position and a more resilient economy for the future.