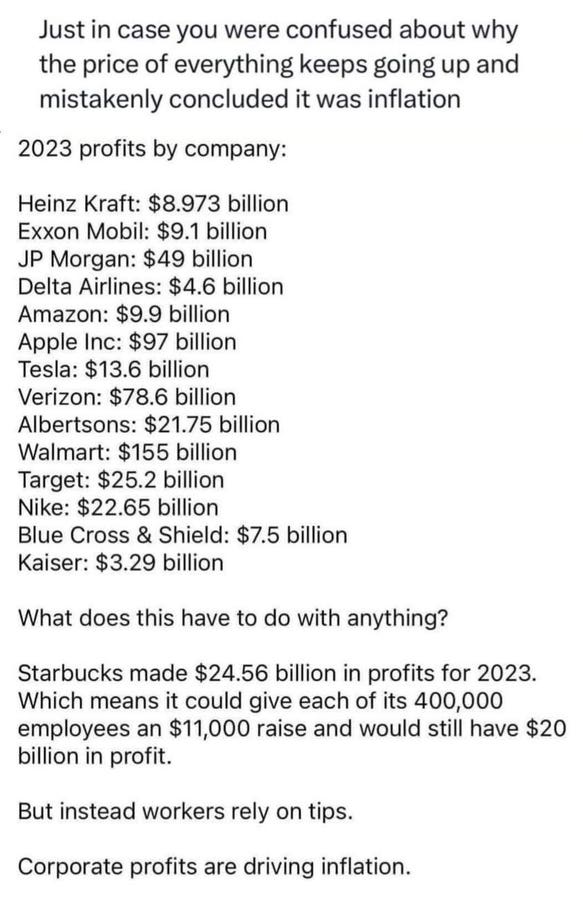

A recent post circulating on social media claims that corporate profits are driving inflation, sparking outrage among many who come across the figures listed. The post includes net income figures for various large companies in 2023, such as The Kraft Heinz Company, Exxon Mobil Corporation, JPMorgan Chase & Co., and more. While some of the figures are accurate, others are significantly off the mark. It’s important to note that companies like Blue Cross & Blue Shield and Kaiser Permanente, which are not public companies and operate differently, do not have profits like the others on the list.

One company singled out for closer scrutiny in the post was Starbucks, possibly due to reasons such as employees advocating for union representation or competitors seeking to short the stock. However, fact-checking reveals that Starbucks’ net income for 2023 was around $4.1 billion, with 381,000 employees worldwide. Assuming that employees in corporate stores receive tips, giving each of them an $11,000 raise would total approximately $4.0 billion, not the $20 billion in profits claimed in the post.

Looking at U.S. Bureau of Economic Analysis estimates of corporate profits before taxes, it seems clear that there has been no $20 billion profit increase as suggested in the post. While there were some unusual effects early in the pandemic when companies closed locations and laid off staff, the overall trend does not support the claim of massively inflated profits. It’s crucial to be cautious of unsubstantiated data presented by anonymous sources and to avoid making hasty investment decisions based on potentially misleading information.

In conclusion, while the idea of corporate profits driving inflation may be a concern for many, it’s essential to verify the accuracy of information before drawing conclusions. Misinformation can take various forms, and blindly accepting claims without proper verification can lead to misguided actions. By scrutinizing data and understanding the complexities of corporate financials, individuals can make informed decisions rather than reacting impulsively to misleading posts on social media. Stay vigilant and seek reliable sources when assessing claims related to corporate profits and their potential impact on inflation.