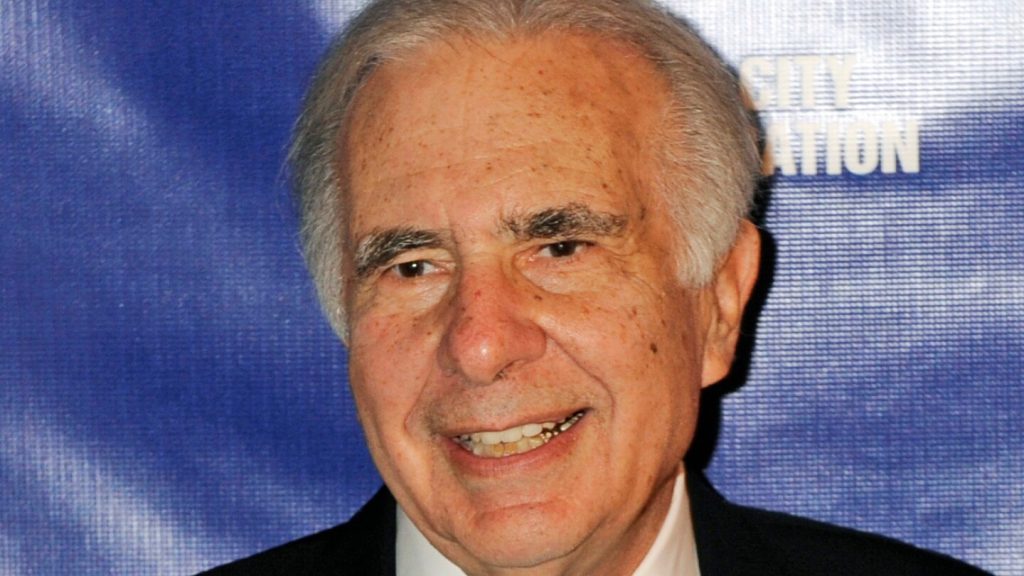

Following the Securities and Exchange Commission’s announcement on Monday, billionaire Carl Icahn and his company, Icahn Enterprises, have agreed to pay $1.5 million and $500,000 in civil penalties, respectively, to settle charges of failing to disclose personal loans worth billions of dollars. The SEC alleged that Icahn pledged a significant portion of Icahn Enterprises’ outstanding securities as collateral for personal loans without disclosing this information as required. The failure to disclose these pledges persisted until February 25, 2022, and Icahn also failed to file required amendments to regulatory filings related to his personal loan agreements dating back to at least 2005.

Icahn gained prominence as a corporate raider in the 1980s, particularly known for his takeover of Trans World Airlines (TWA) in 1985. The airline filed for bankruptcy in 1992, emerging a year later but subsequently operating at a loss and eventually selling its assets to American Airlines in 2001. In February, Icahn took a nearly 10% stake in JetBlue, showcasing his continued interest in the aviation industry. Despite his past successes and failures, Icahn Enterprises and Icahn have agreed to cease and desist from future violations without admitting or denying the SEC’s findings and pay the accompanying civil penalties.

In May 2023, Icahn Enterprises faced a sharp decline in its shares following a report by short-selling firm Hindenburg Research. The report alleged that the company had been using inflated asset valuations and highlighted questionable economic structures, describing them as “ponzi-like.” Hindenburg also claimed that Icahn had used funds from new investors to pay dividends to existing ones, raising concerns about the company’s financial practices. Icahn responded to the report, accusing Hindenburg of spreading false information for its own financial gain and causing damage to Icahn Enterprises and its investors. Despite these challenges, Icahn expressed relief at putting this matter behind and reiterated his commitment to the company’s operations.

Icahn’s statement on Monday addressed the SEC’s findings and pushed back against Hindenburg’s allegations, emphasizing that the settlement did not imply any wrongdoing related to inflated asset values or ponzi-like structures. He criticized Hindenburg’s tactics of publishing unsupported claims that ultimately harmed Icahn Enterprises and its investors. The company’s shares fell more than 6% in response to the SEC settlement, reflecting the impact of these regulatory and market developments on investor confidence. Icahn reassured stakeholders of his focus on operating the business for the benefit of unit holders, signaling a determination to move past this controversy and continue with the company’s operations.

The settlement between Icahn Enterprises, Carl Icahn, and the SEC marks a resolution to the charges of failing to disclose personal loans secured by Icahn’s holdings in the company. The agreement includes payment of civil penalties and commitments to refrain from future violations, signaling a commitment to transparency and regulatory compliance. Despite the financial implications of the settlement and the challenges posed by negative reports from short-selling firms, Icahn remains committed to the company’s operations in various sectors, including aviation. The fallout from these events underscores the importance of regulatory compliance and maintaining investor trust in the face of external scrutiny and market volatility. As Icahn Enterprises navigates these challenges, the company’s ability to address regulatory concerns and maintain operational focus will be key to its future performance and investor confidence.