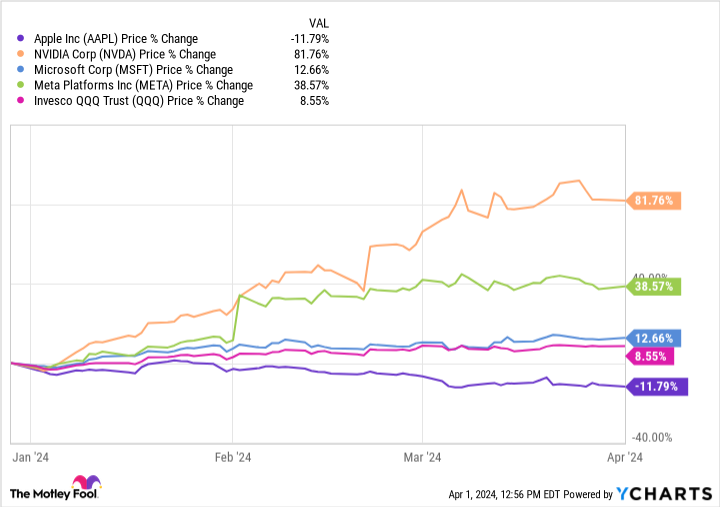

One of the iconic tech companies, Apple, stands out as the only one among Nvidia, Microsoft, Meta, and Apple that is down year to date (YTD). Apple’s stock is down nearly 12% this year and 14% from all-time highs, while the other high-flyers are regularly breaching all-time highs. Despite facing challenges such as a struggling consumer economy in China and a challenge from the Department of Justice (DOJ) in the U.S., Apple remains a powerhouse in the tech industry.

Apple has faced challenges due to the drying up of pandemic-era stimulus, which coincided with inflation impacting people’s budgets. Investor focus has shifted towards artificial intelligence (AI), an area where Apple is a minor player. The biggest challenge for Apple is the Chinese market, which accounted for a significant portion of its revenue and operating income. Chinese competitors like Huawei are gaining market share, with reports indicating a decline in iPhone sales in China.

Despite these challenges, there are reasons for optimism regarding Apple’s stock. The strength of the U.S. consumer market, the growth of Apple’s Services segment, and the company’s generous return of capital to shareholders are positive indicators. Apple’s operating income rose 12% in the last quarter, demonstrating resilience amid market challenges. The Services segment, which includes Apple Pay, iCloud subscriptions, and advertising, has shown exponential growth and high profitability for the company.

Apple’s extensive buyback program and dividend payments have been rewarding for shareholders, with $432 billion returned since fiscal 2020. The recent release of Apple Vision Pro, a wearable device that offers various functionalities, showcases Apple’s commitment to innovation and revenue diversification. With a price-to-earnings (P/E) ratio of 26.7, slightly below its historical averages, Apple stock remains an attractive investment option for interested investors.

Investors interested in Apple should consider buying slowly over time to take advantage of price dips amid the current negative sentiment surrounding the stock. While Apple may face challenges in the Chinese market and competition in the tech industry, its resilience, innovative products, and strong financial performance make it a compelling long-term investment opportunity. Interested investors should also explore other potential investment opportunities identified by The Motley Fool Stock Advisor analyst team, who have identified 10 stocks with significant growth potential in the coming years.