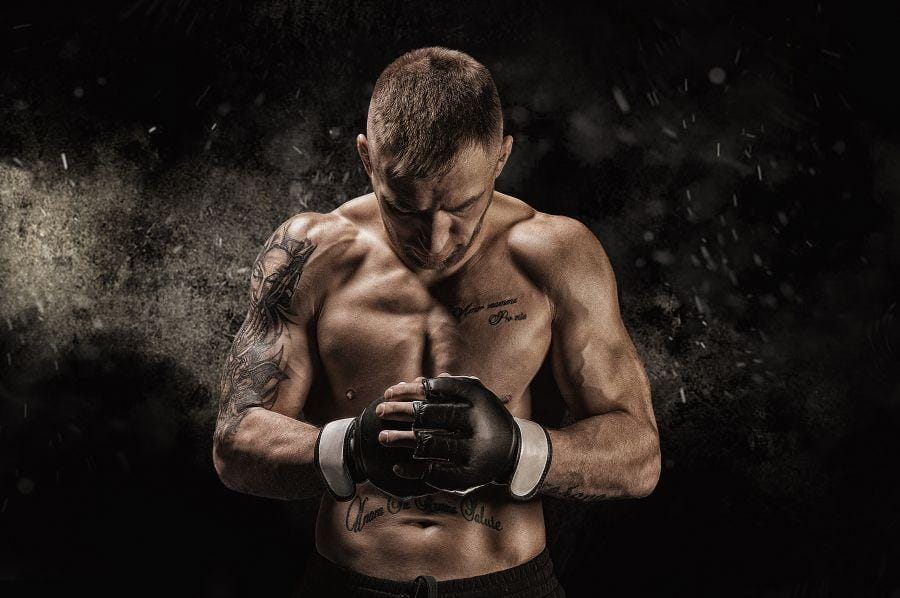

VeChain has partnered with the UFC to tokenize fighter gloves and track their identities using the VeChainThor network. Through the use of NFC chips embedded in the gloves, fight data can be recorded and the authenticity of each pair ensured. After the fights, the gloves will be donated and given away, turning them into collector’s items that buyers can verify through a VeChainThor network smart contract. The collaboration aims to address fraud in the secondary market where buyers seek gloves worn during specific fights, and VeChain’s ToolChain system will streamline the tracking and delivery process of these items to their intended recipients. The initial release of 12 exclusive gloves will be distributed to A-list celebrities, including Joe Rogan, with UFC CEO Dana White making a live presentation to announce the partnership.

The response from the VeChain community to the partnership with UFC has been mixed, with some expressing enthusiasm for the potential of minting real-world asset gloves as NFTs for every UFC event. Others welcomed the idea of merchandise tracking and suggested incorporating QR code scanning during televised events, which would contribute to burning VeThor tokens. However, some community members were not impressed by the announcement, believing that the transaction fees associated with the gloves would not burn enough VTHO to impact the token’s price significantly. As of April 12, VeThor had a market capitalization of over $283 million, positioning it among the top 300 cryptocurrencies globally.

The partnership between VeChain and UFC began in June with a $100 million sponsorship deal, solidifying their collaborative efforts within the mixed martial arts promotion. In a report earlier this year, Moody’s revealed that the value of tokenized funds surged from $100 million at the beginning of 2023 to approximately $800 million, driven by the tokenization of U.S. treasuries. Both public and private blockchains are seeing the inclusion of various assets, with examples such as Franklin Templeton’s U.S. Government Money Fund expanding from Stellar to Polygon, Backed Finance launching a tokenized short-term U.S. treasury bond ETF, and UBS Asset Management deploying a tokenized MMF on the Ethereum blockchain. Tokenization of MMFs offers the potential to combine stability with the technological advantages of stablecoins.

DigiFT, a Singapore-based fintech company, recently announced the launch of its US Treasury bill depository receipt tokens, further showcasing the growing popularity of tokenized funds. The collaboration between VeChain and UFC, along with the broader trend of tokenization in the financial industry, highlights the increasing adoption of blockchain technology across different sectors. The ability to tokenize assets and track their identities on a blockchain network offers transparency, security, and authenticity to participants in various industries, including sports and finance. As the ecosystem continues to evolve and integrate blockchain technology, we can expect to see more innovative use cases and partnerships emerge, driving further growth and adoption in the space.