The deadline to file taxes is approaching, and over 40 million Spanish-speaking residents in the U.S. are finally receiving help from the IRS and TurboTax. Maria Purser, a San Diego accountant, has been using TurboTax to help her immigrant parents with their taxes for 15 years. Her Venezuelan parents, now in their late seventies, prefer speaking Spanish and rely on Purser to translate and explain the complex tax forms to them. With the new Spanish version of TurboTax, Purser hopes this year’s tax filing will be easier for her parents.

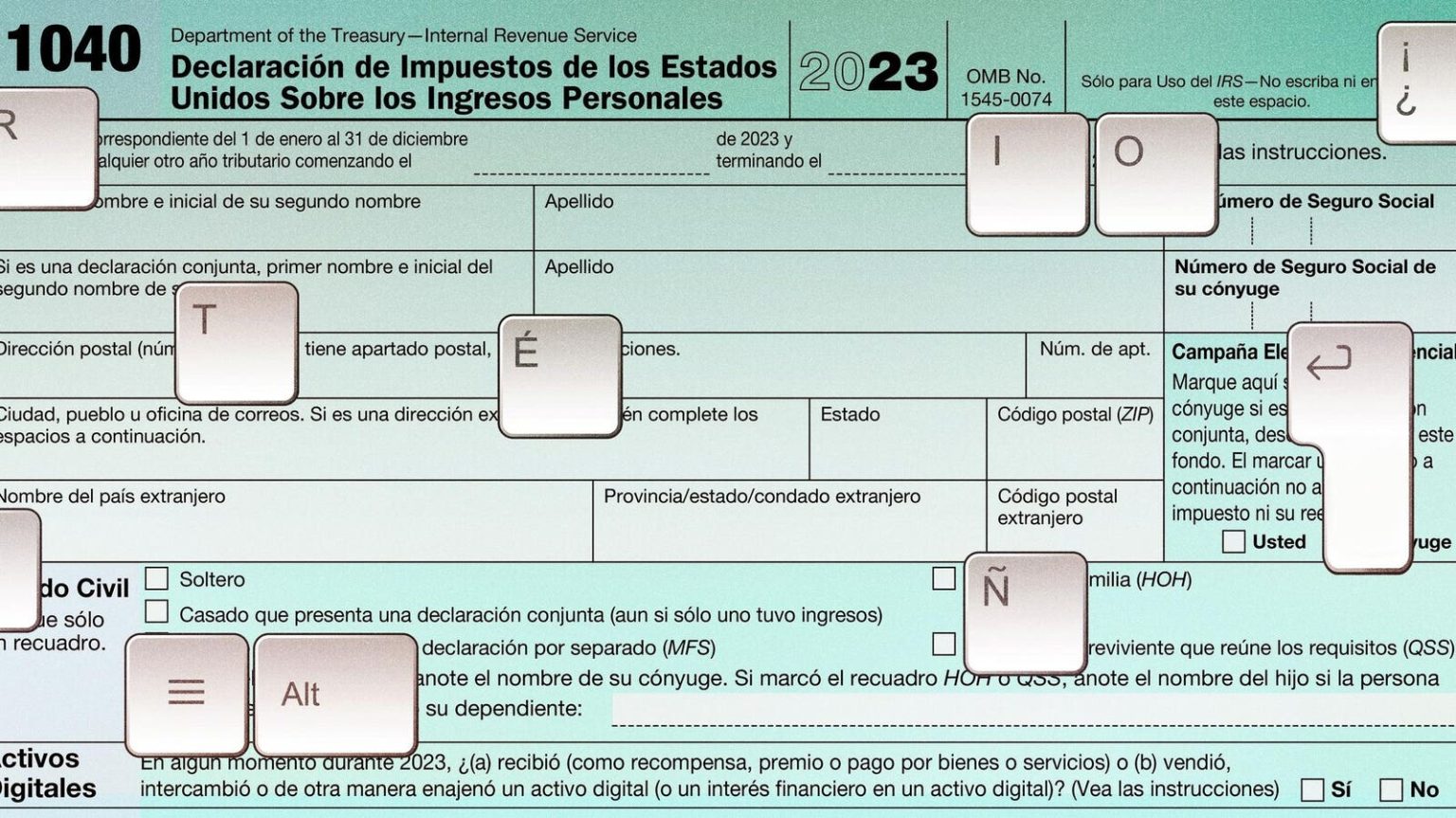

According to the U.S. Census Bureau, 68 million U.S. residents spoke a language other than English at home in 2019, with 42 million being Spanish speakers. The IRS has been slow to provide services in languages other than English, but recent efforts have led to translations, including a Spanish version of the Form 1040 and other tax-related materials. TurboTax, the leading consumer tax software, has also launched a full suite of products in Spanish for the 2023 tax season, catering to the growing population of Spanish-speaking taxpayers.

The IRS now offers 142 tax forms, instructions, and publications in Spanish, along with a pilot program that allows taxpayers in 12 states to file directly with the IRS in Spanish. The agency has made strides in providing services to traditionally underserved taxpayers, including bilingual support. While there are still challenges, such as only one of the eight FreeFile partners offering a Spanish option, the IRS is working to improve access for all taxpayers.

TurboTax’s move to offer a complete bilingual product suite was a long-term goal for Intuit’s Consumer Group. The company has incorporated human tax analysts to review and create tax content, which is then translated using AI technology. TurboTax has also introduced a bilingual chatbot powered by AI, providing free assistance to users in both English and Spanish. While there are still limitations, such as complex questions needing human experts, the AI chatbot aims to enhance user experience.

Other tax professionals, like Carlos López of Latino Tax Pro, are also leveraging AI technology to improve efficiency in their businesses. López offers a service called Ask A Tax Pro, providing personalized tax advice within 24-48 hours. By utilizing AI and speech-to-text applications, tax professionals can better serve clients with diverse language needs. With the growing demand for multilingual tax services, AI tools are becoming essential for tax professionals to streamline operations.

TurboTax’s aggressive marketing campaign in the Hispanic community, including collaborations with influencers like Marianna Girgenti, showcases the importance of providing tax services in multiple languages. Girgenti, a Venezuelan-American architect and social media influencer, has partnered with TurboTax to create engaging content for Spanish-speaking audiences. Through events, live streams, and social media campaigns, TurboTax aims to reach a broader audience and assist users with their tax filing needs.

In conclusion, the efforts by TurboTax and the IRS to provide bilingual tax services are essential in supporting the diverse population of Spanish-speaking taxpayers in the U.S. With the use of AI technology and bilingual support, taxpayers like Maria Purser and her parents can now navigate the tax-filing process with greater ease. As the deadline for filing taxes approaches, these resources are crucial in ensuring that all taxpayers have access to the assistance they need to fulfill their tax obligations.