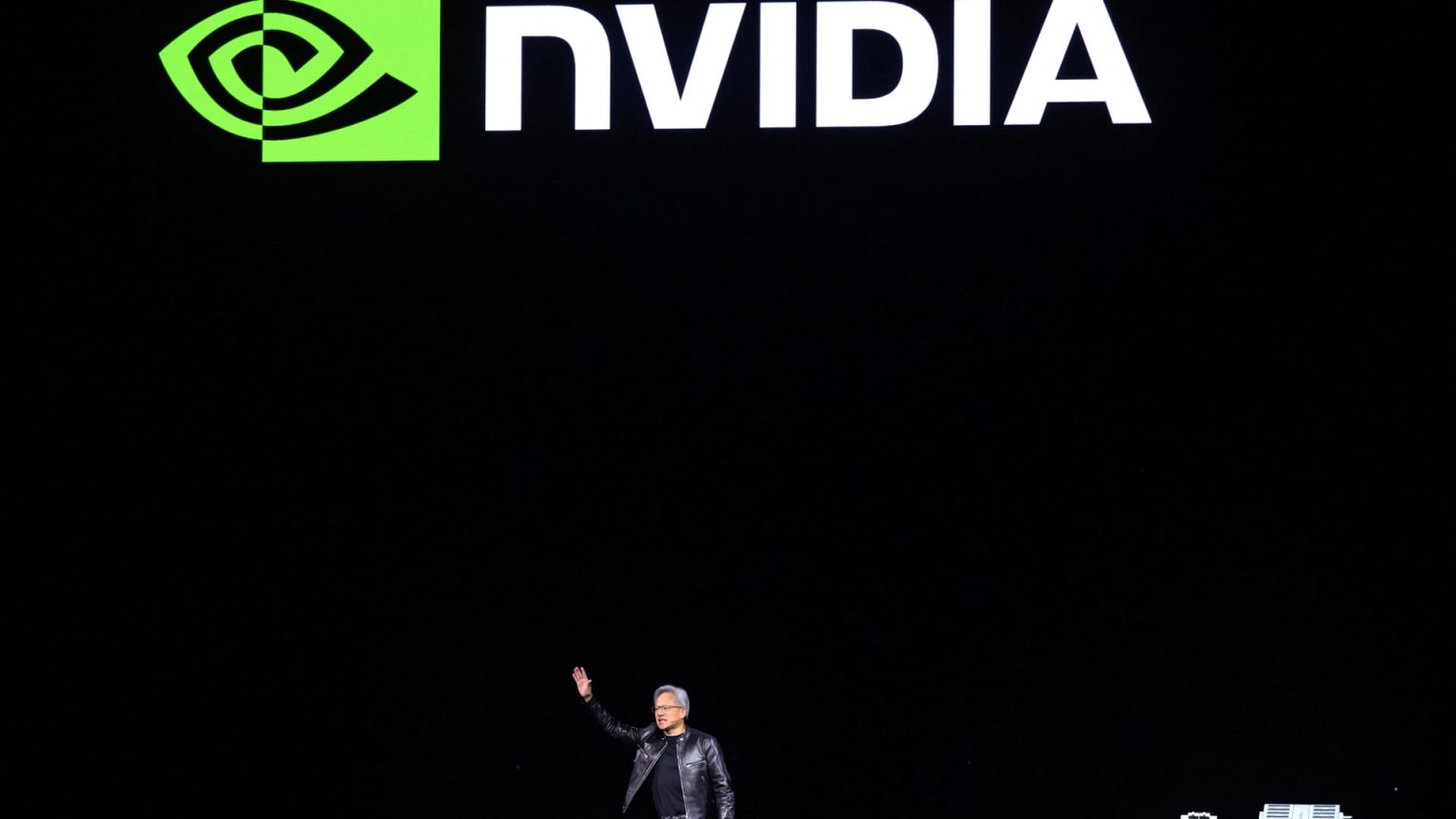

Several companies made headlines in midday trading, with Nvidia seeing an 11% spike following strong fiscal first-quarter results, better-than-expected guidance, and a 10-for-1 stock split announcement. Other AI and semiconductor names also rallied on the news. Super Micro Computer saw a 1.2% rise in its shares. However, Boeing saw a 6% drop after CFO Brian West stated that he expects negative free cash flow and that aircraft deliveries won’t recover in the second quarter from the first due to production challenges with its best-selling planes.

Live Nation Entertainment shares dropped by 7% after the U.S. Department of Justice sued to break up the parent company of Ticketmaster, alleging antitrust violations. On the other hand, E.l.f. Beauty surged by 21% after surpassing fiscal fourth-quarter estimates on both the top and bottom lines, posting adjusted earnings of 53 cents per share on revenues of $321.1 million, surpassing analyst expectations. LiveRamp witnessed a 7% increase in its shares following stronger-than-expected earnings for the fiscal fourth quarter and issuing strong current-quarter and full-year revenue guidance.

GoodRx saw a 3% gain after being upgraded to outperform from sector perform by RBC, citing notable growth opportunities for the telemedicine company. Taiwan Semiconductor gained 2% after forecasting annual revenue growth of 10% for the global semiconductor industry. However, Snowflake experienced a 3% dip in its shares despite better-than-expected first-quarter revenue and a higher annual product revenue outlook, falling short on adjusted earnings for the period.

Titan Machinery tumbled by 17% after posting first-quarter earnings and revenue that missed expectations. Triumph Group saw an 11% slide in its stock following earnings guidance below the FactSet consensus estimate. Cytokinetics plunged by 15% after announcing a $500 million common stock offering led by JPMorgan, Goldman Sachs, and Morgan Stanley. VF Corp’s shares fell by 3.5% after the apparel and footwear company reported an unexpected loss per share for its fiscal fourth quarter and missed revenue estimates.