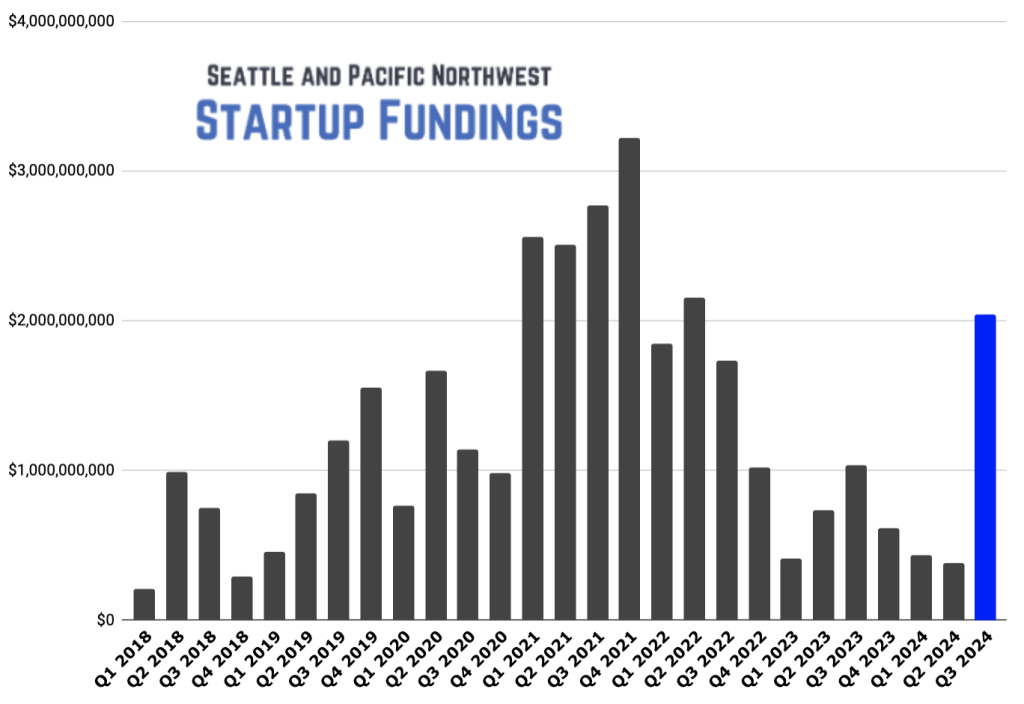

In the third quarter of the year, venture capital funding to startups in the Pacific Northwest showed positive momentum. Privately held tech companies in the region raised over $2 billion across 44 deals, a significant increase from the previous quarter and from the same period in the previous year. One standout deal was a massive $900 million round for Vancouver-based legal tech giant Clio in July, which made up nearly half of the total funding for the region in Q3. Biotech and healthcare startups also raised significant rounds, with companies like Kestra Medical Technologies, Borealis Biosciences, and Outpace Bio securing over $100 million in funding. Cybersecurity firm Chainguard also received a notable investment of $140 million, making it a new unicorn in the Seattle region.

Carly Kiser, managing director of innovation economy banking at J.P. Morgan, noted increased optimism about fundraising, particularly in critical sectors like AI, cybersecurity, infrastructure, and clean tech. While there may be a slowdown in funding activity in the back half of Q4 due to the typical end-of-year pause and the U.S. election, Kiser expects activity to pick up again in early 2025. The overall venture capital market remains tepid compared to the record highs of 2021. Although total deal value for the year is expected to surpass 2020 levels, higher interest rates and fewer exits are causing investors to be more cautious. Venture investors are focusing on quality over quantity, spending more time on due diligence and advocating for more investor protections in term sheets.

Despite the overall cautious sentiment in the venture capital market, Seattle and the broader Pacific Northwest region saw some significant funding rounds in Q3. Top deals included funding rounds for companies based in the region, highlighting the strength and diversity of the startup ecosystem. These investments cover a range of sectors, including technology, biotech, healthcare, and cybersecurity, reflecting the region’s innovation and expertise in various industries. The region continues to attract funding and interest from investors, signaling confidence in the potential growth and success of Pacific Northwest startups.

The data from GeekWire’s funding list shows a positive trend in venture capital funding for Pacific Northwest startups in Q3. With over $2 billion raised across 44 deals, the region saw a significant increase in funding compared to previous quarters. Key investments in legal tech, biotech, healthcare, and cybersecurity firms contributed to the overall growth in funding activity. The region’s strong focus on critical sectors like AI, cybersecurity, infrastructure, and clean tech, as mentioned by industry experts, is driving continued momentum in fundraising. Despite potential slowdowns in the coming months, the outlook for early 2025 remains positive for startups in the Pacific Northwest.

The PitchBook-NVCA Venture Monitor report also highlights the cautious approach of venture investors in the current market environment. While total deal value is expected to surpass previous levels, higher interest rates and fewer exits are leading investors to prioritize quality deals and investor protections. The report emphasizes the importance of due diligence and prudent decision-making in the current market conditions. Despite these challenges, the Pacific Northwest region continues to attract significant funding, with notable investments in key sectors driving growth and innovation. The diversity of startups in the region and the strength of the ecosystem are contributing to sustained interest from investors, laying the foundation for future funding opportunities and growth in various industries.

Overall, the venture capital funding landscape in the Pacific Northwest is showing positive signs of growth and momentum in Q3. The region’s startups attracted over $2 billion in funding across various sectors, with key investments in legal tech, biotech, healthcare, and cybersecurity. Industry experts remain optimistic about fundraising activity in critical sectors like AI, infrastructure, and clean tech, despite potential slowdowns in the near future due to external factors. The cautious approach of venture investors, as highlighted in the PitchBook-NVCA Venture Monitor report, underscores the need for quality deals and investor protections in the current market environment. Despite these challenges, the Pacific Northwest region continues to demonstrate its resilience and appeal to investors, positioning it well for future growth and success in the startup ecosystem.