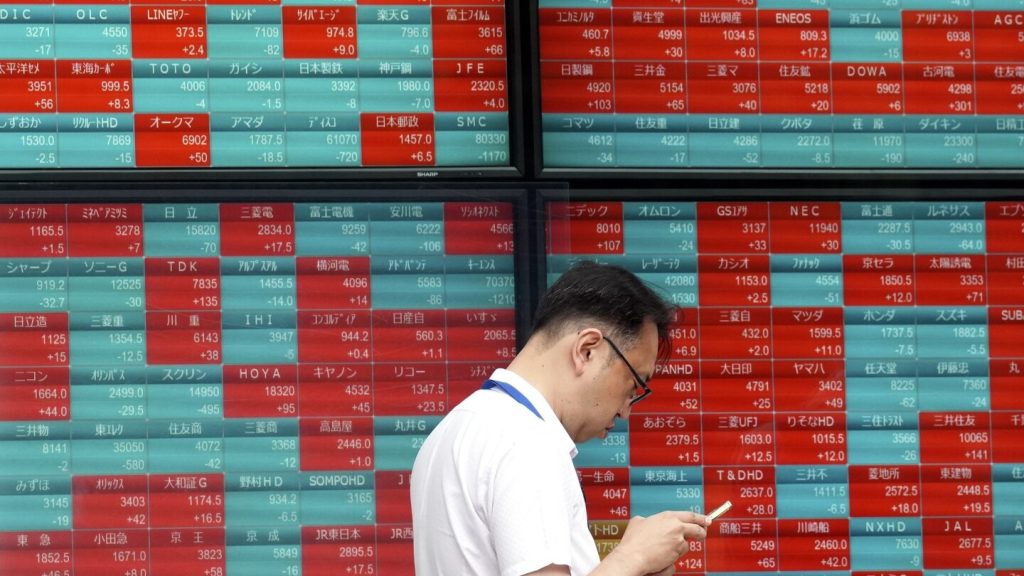

Asian shares traded mixed on Wednesday as investors assessed recent data on the slowing U.S. economy. Japan’s Nikkei 225 dropped 1.0%, while Australia’s S&P/ASX 200 edged up 0.3%. South Korea’s Kospi jumped 1.2%, and Hong Kong’s Hang Seng added 1.2%. Analysts predict that Japan may raise interest rates following recent data on wage growth. In the U.S., the S&P 500 and Dow Jones Industrial Average rose, while the Nasdaq composite also saw gains.

The bond market saw a decline in Treasury yields after a report showed fewer job openings in the U.S. than anticipated. Wall Street hopes for a slowdown in the economy to control inflation and possibly lead to interest rate cuts by the Federal Reserve. However, the risk of a recession looms, which could result in layoffs and reduced corporate profits. The recent report on job openings in the U.S. indicates a return to a normal job market post-COVID-19, according to an economist.

Concerns about a slowing economy impacted the price of crude oil, leading to a drop in demand for fuel. U.S. crude oil prices fell nearly 5% this week, causing oil and gas stocks to suffer losses. Companies tied to the economic cycle, like steel and mining firms, also saw declines. On the flip side, dividend-paying stocks and certain tech stocks performed well, benefiting from lower interest rates. The U.S. dollar rose against the Japanese yen, while the euro remained relatively stable.

Recent data on U.S. manufacturing contracting in May further fueled worries about a slowing economy. The possibility of reduced growth in fuel demand contributed to the decline in crude oil prices. Companies reliant on the economic cycle, such as steel makers and mining firms, faced losses, while dividend-paying stocks and some tech stocks saw gains. Despite challenges in the market, investors continue to monitor economic indicators and anticipate potential policy shifts by central banks.

The fluctuating performance of Asian shares reflects ongoing uncertainty surrounding the global economy. As investors analyze data pointing to a slowing U.S. economy, there is caution about potential negative impacts on various sectors. The divergence in stock performance highlights the complex interplay between economic indicators, policy decisions, and market sentiment. Amidst these challenges, investors remain vigilant in navigating the dynamic landscape of financial markets to capitalize on opportunities and manage risks effectively.