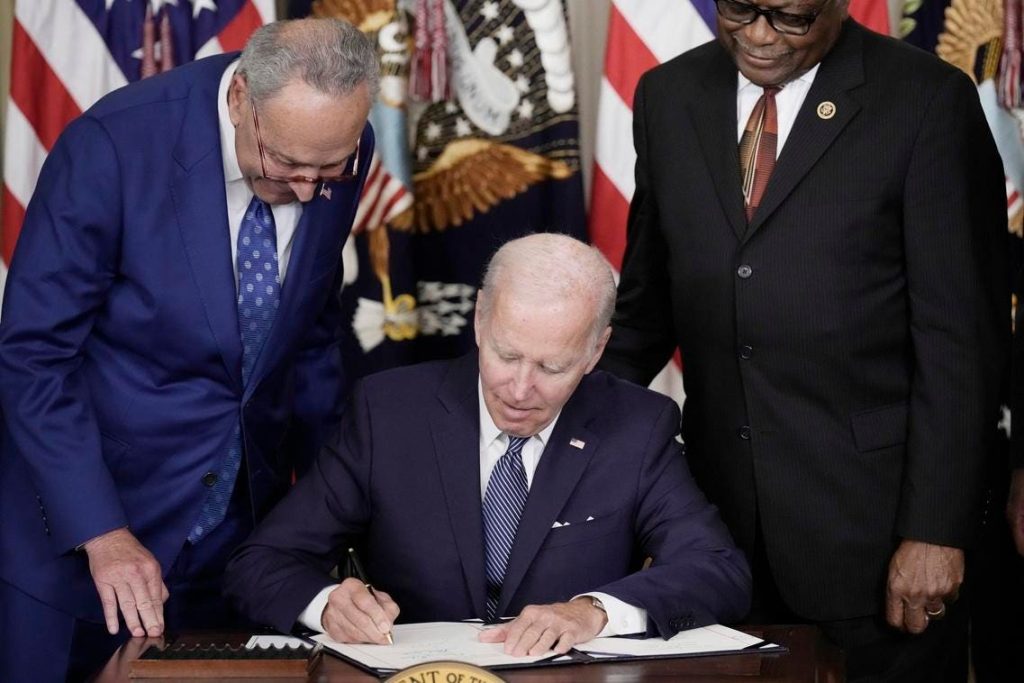

The Inflation Reduction Act, signed into law in 2022 as part of President Biden’s Investing in America Agenda, aims to help small businesses and working Americans by investing in deficit reduction to fight inflation, increasing manufacturing, lowering drug prices, and leveling the playing field in terms of taxes. Despite being nearly two years old, there is still ongoing debate about the effectiveness of this policy, especially in an election year. However, there are several provisions of the act that can benefit entrepreneurs and main street businesses when it comes to taxes.

One key provision of the Inflation Reduction Act is investing in fairer taxes. The legislation provides additional funding for the IRS to make up for decades of underfunding, enabling the agency to hire more agents to collect revenue from high-earning taxpayers and large corporations using tax gimmicks to avoid paying their fair share. This effort seems to be paying off, with the IRS reporting recouping an additional $360 million in overdue taxes from delinquent millionaires. It is estimated that tax revenues will increase by as much as $561 billion from 2024 to 2034 as a result of these efforts.

Another important provision of the act is doubling the research and development tax credit for small businesses. The refundable credit was increased from $250,000 to $500,000, allowing businesses to apply it against payroll taxes and various expenses related to product development and technology. This could lead to greater private sector investment, as studies have shown that $1 of research and development tax credit can result in about $4 of long-term research and development spending.

The Inflation Reduction Act also includes consumer tax credits, particularly in the clean energy sector. Homeowners can receive tax credits for installing electric heat pumps, rooftop solar, geothermal systems, and battery storage. Additionally, families making energy efficiency improvements to their homes can receive tax credits for doors, windows, home energy audits, and insulation. For transportation, the act provides consumer tax credits for lower- and middle-income individuals to purchase used electric vehicles, with the Department of Energy estimating that these provisions will cut electricity rates by up to 9% by 2030.

There are still opportunities to take advantage of the tax credits and provisions in the Inflation Reduction Act and other areas of the Investing in America agenda. Interested individuals can visit the Treasury Department’s Inflation Reduction Act Taxpayer Resource Hub to explore potential opportunities that may be beneficial for them. Overall, the act aims to support businesses and individuals in various ways, from fairer tax policies to incentives for clean energy investments, ultimately contributing to economic growth and stability.