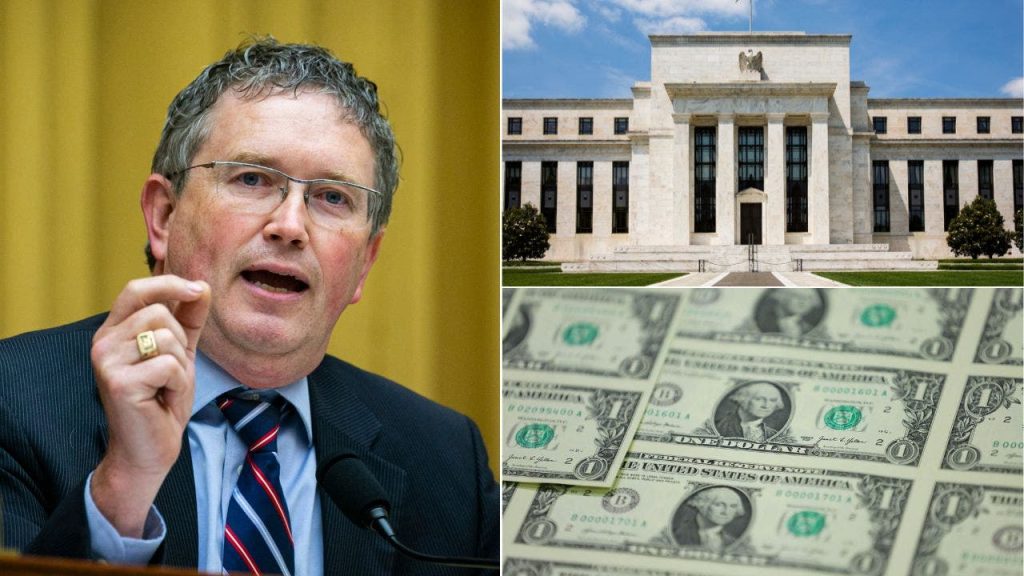

Rep. Thomas Massie, a Republican from Kentucky, has introduced the Federal Reserve Board Abolition Act, which seeks to end the Federal Reserve, the central banking system that has been in operation for over a century. The bill would abolish the Board of Governors of the Federal Reserve and its banks, as well as repeal the Federal Reserve Act of 1913. Massie blames the Federal Reserve for rapid inflation and the devaluation of the dollar, citing the creation of trillions of dollars out of thin air during the COVID pandemic as a key factor in current economic challenges.

According to Massie, the Federal Reserve’s practice of monetizing debt has led to high inflation and benefited the wealthy and well-connected at the expense of ordinary Americans. By loaning trillions of dollars to the Treasury Department to enable deficit spending, the Federal Reserve has devalued the dollar and enabled policies that have caused the current inflationary environment. Massie, a Libertarian Republican who opposes big government spending, believes that ending the Federal Reserve is the most effective policy to reduce inflation and improve the economic situation for Americans.

The bill to abolish the Federal Reserve is co-sponsored by several other Republican representatives, including Andy Biggs, Lauren Boebert, and Matt Gaetz, among others. Massie’s move to introduce this legislation comes after teasing the idea on social media and receiving support from his followers. The bill is part of a long history of attempts to end the Federal Reserve, with the first iteration of the Federal Reserve Board Abolition Act introduced by former Rep. Ron Paul in 1999. Paul, known for making the issue central to his presidential campaigns, also introduced the Federal Reserve Transparency Act in 2009, a bill that Massie has reintroduced.

In addition to his efforts to abolish the Federal Reserve, Massie has also introduced a bill to audit the Federal Reserve, seeking greater transparency and accountability in its operations. The Federal Reserve Transparency Act of 2023 would provide insight into the central bank’s activities and decision-making processes, shedding light on its impact on the economy and financial system. These legislative efforts reflect Massie’s commitment to reducing government intervention in the economy and ensuring that policies benefit all Americans, rather than a select few.

The push to end the Federal Reserve and increase transparency in its operations has garnered support from other lawmakers, including Senator Elizabeth Warren and progressive factions, who are urging the Federal Reserve to lower interest rates. The debate over the role of central banking and its impact on the economy is at the forefront of political discussions, with differing viewpoints on how best to address issues such as inflation, economic growth, and financial stability. Massie’s legislation represents a significant step towards reshaping the country’s financial system and addressing longstanding concerns about the Federal Reserve’s role and influence.

As the debate over the Federal Reserve and its future continues, lawmakers are grappling with the consequences of monetary policy decisions and their impact on the economy. Massie’s bill to abolish the Federal Reserve and increase transparency is part of a broader conversation about the role of central banking in a modern economy and the need for reforms to address economic challenges. Whether or not the Federal Reserve Board Abolition Act is passed into law, it highlights the ongoing efforts to reform the financial system and ensure that policies serve the interests of all Americans.