Financial markets experienced a week of volatility leading up to the release of the employment report on April 5th. Despite a strong report on the surface, showing positive job growth, the markets still ended the week with lower prices in both equity and fixed income markets. This is possibly due to concerns in the manufacturing sector, as seen in the underperformance of the Dow Jones Industrials compared to other indexes.

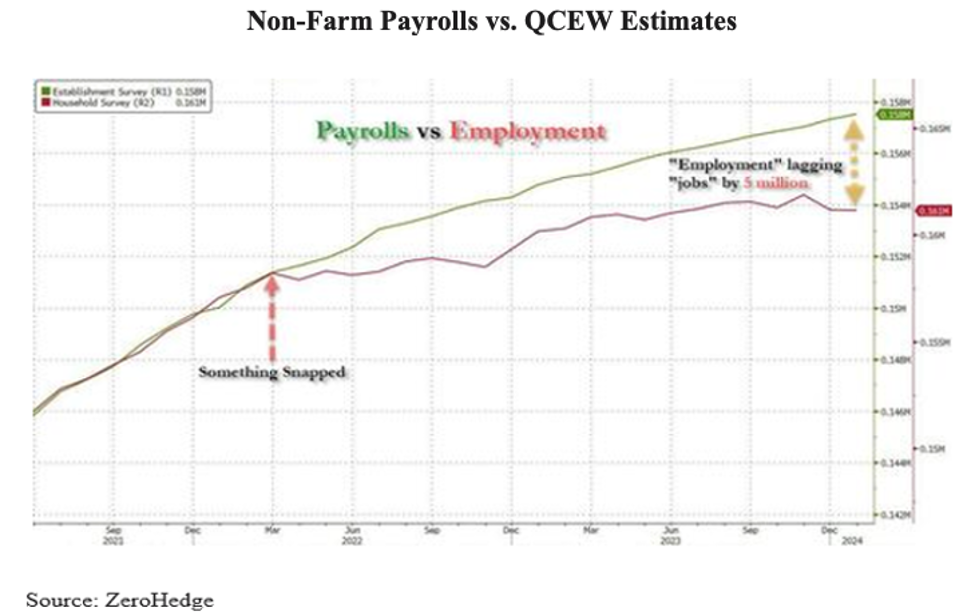

There are discrepancies between the Non-Farm Payrolls (NFP) and the Quarterly Census of Employment and Wages (QCEW) data, with NFP showing five million more jobs than QCEW. Additionally, the Birth/Death (B/D) model adds around +100K jobs to NFP to account for the growth of small businesses, but recent data shows a decrease in new business “births” and an increase in “deaths,” casting doubt on the accuracy of the reported job growth.

Data from the QCEW reveals a decline in full-time jobs and a rise in part-time jobs, indicating a weakening economy despite the headline job growth numbers. The discrepancy between NFP and the Household Survey (HS) data, which has shown negative job growth in 2024, further raises concerns about the accuracy of the employment figures being reported.

The commercial real estate (CRE) and banking crisis is looming, with leveraged loan delinquencies exceeding 6% and office vacancies at record highs. CRE prices are declining, with a significant portion of CRE loans having negative equity. As CRE foreclosures increase, banks, which hold half of all CRE debt, may experience rising loan loss reserves, leading to capital issues and potentially a recession.

The Federal Reserve has indicated that they need to see more progress on inflation before considering lowering rates. Interest rates have been rising, with the 10-Year Treasury yield increasing from December to April. Despite positive signals from Fed Chair Powell about potential rate cuts in 2024, market odds for a rate cut in June are low, reflecting the uncertainty surrounding the economy and inflation.

In conclusion, there are concerns about the accuracy of employment data, the impact of the looming CRE and banking crisis, and the potential for rate cuts by the Federal Reserve. The economic outlook remains uncertain, with various indicators pointing to a weakening economy and potential recession. Financial markets are closely monitoring these developments, which could have significant implications for investors and the overall economy.