A couple recently faced unexpected challenges following the birth of their newborn, which resulted in the father having to take on more responsibilities due to the mother’s emergency surgery. The father initially believed he couldn’t handle the situation and sought evidence to confirm his inability to act effectively, leading to a state of paralysis. This pattern of thought is common in personal finance, where individuals may feel overwhelmed by tasks such as budgeting, estate planning, and investing.

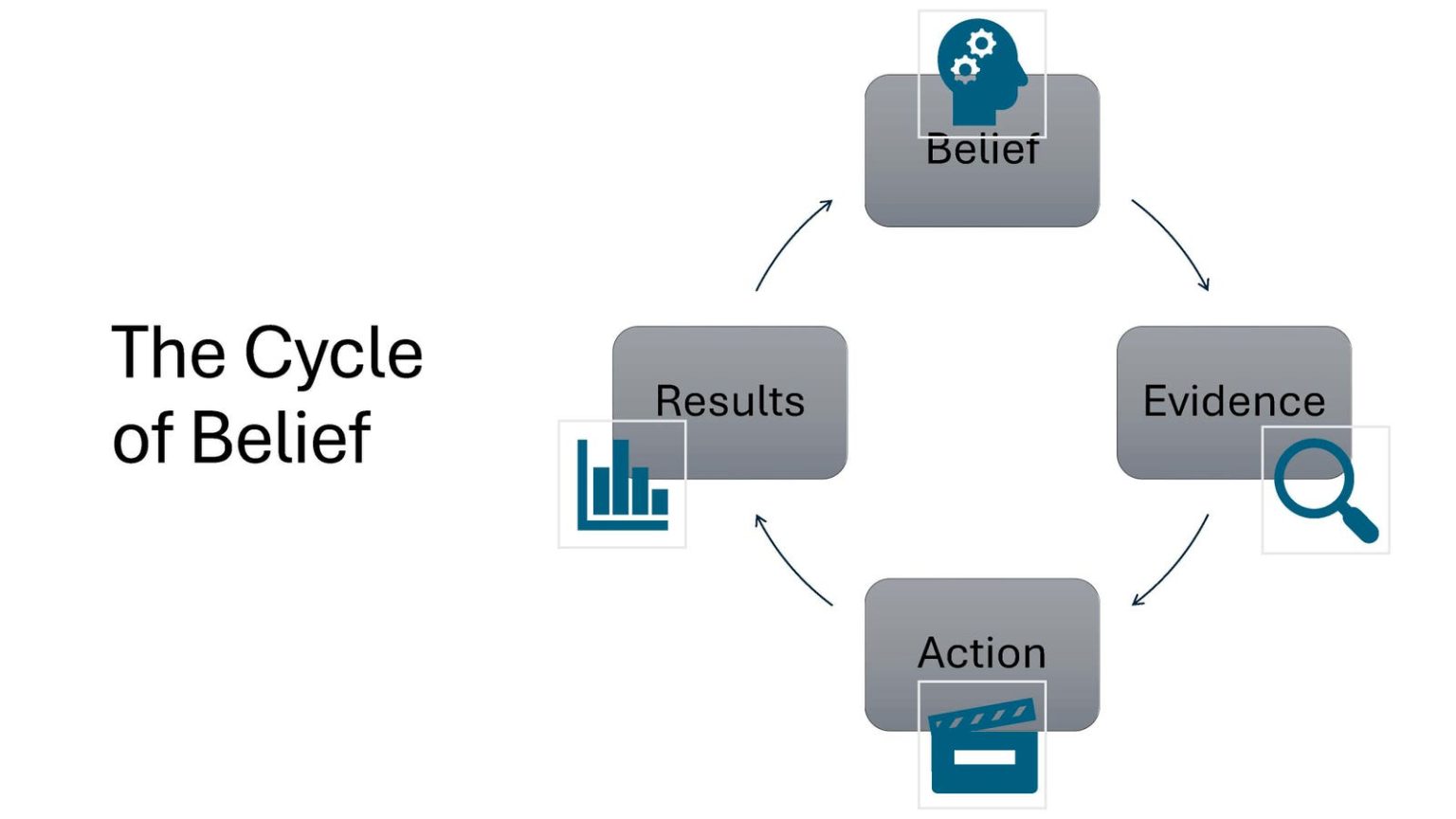

The complexity of financial matters, combined with external pressures from the financial industry and legal and accounting sectors, can contribute to feelings of incapability in financial planning. This mindset can ultimately lead to financial failure, as individuals may not take necessary actions to secure their financial future. The concept of confirmation bias explains how individuals seek out evidence to support their beliefs, leading to self-fulfilling prophecies.

In order to break free from negative beliefs, individuals must change the story they tell themselves and rewire their thinking. By acknowledging the facts of a situation and seeking out resources and support, individuals can gain confidence in their abilities to handle challenges. The father in the story found guidance in nurse’s instructions and a baby care manual, which helped him create a game plan for caring for his newborn and supporting his recovering wife.

The transition from believing “I can’t do this” to “I can do this well” was a turning point for the father, as he realized his capabilities and sought assistance when needed. Financial planning, particularly budgeting and cash flow management, is often seen as daunting tasks, but they are fundamental elements that individuals must address to secure their financial well-being. Seeking professional help in areas where one lacks expertise is crucial to building a solid financial foundation.

Overall, individuals must challenge their limiting beliefs and consider questioning their assumptions to overcome obstacles in various aspects of life, including financial matters. By addressing basic financial planning elements and seeking help when necessary, individuals can build confidence and take control of their financial future. The cycle of belief can help individuals address and overcome challenges, leading to improved outcomes in personal finance and beyond.