The NVIDIA SPDR Dow Jones Industrial Average ETF Trust stock has been rising significantly, reflecting the current trend of hot stock cycles. This surge is fueled by the hype surrounding artificial intelligence and the potential profits that investors, venture capitalists, tech executives, and Wall Street stand to gain from its success. However, there are concerns about the excessive hype surrounding AI and whether it accurately represents the technology’s capabilities.

The relentless promotion and advertising of AI have led to a saturation of the market with inflated expectations. There are suspicions about the connections between LinkedIn executives, venture capitalists, and private equity individuals who benefit from the AI hype. This includes intrusive prompts on platforms like LinkedIn suggesting that AI could generate content, without user consent or preference. Despite the legalities, such tactics are seen as insulting and raise questions about the transparency and integrity of those involved.

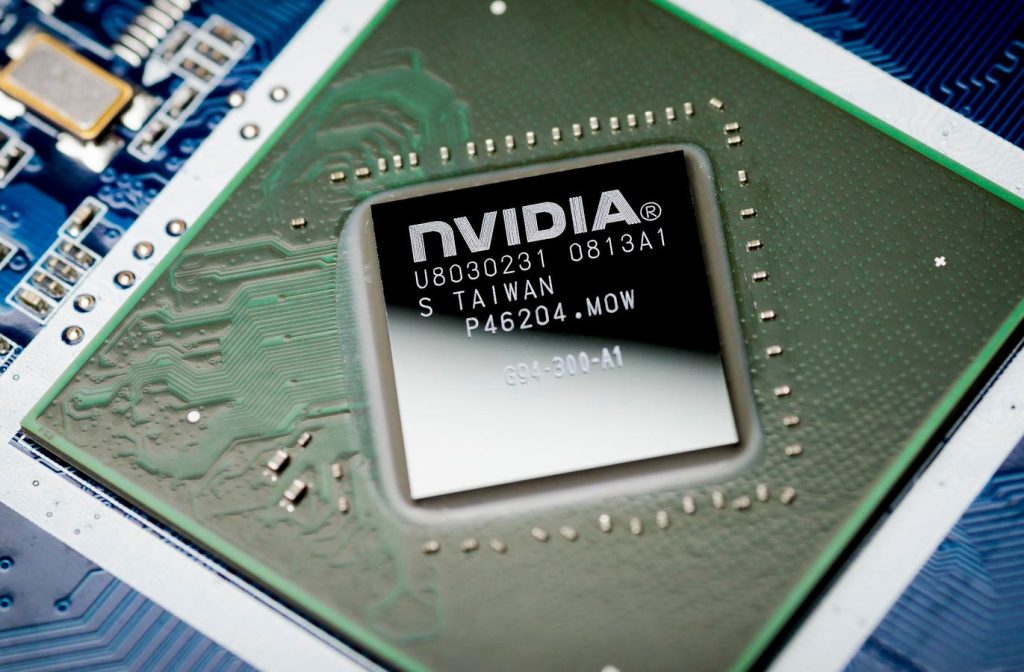

While investors remain optimistic about the potential of AI and NVIDIA’s AI-chips driving the stock to new heights, there are underlying issues that could pose challenges. Recent articles have highlighted significant problems with existing AI technology, including plagiarism, ethical concerns, misinformation, and bias. These issues could impact the success and sustainability of AI-driven technologies, raising doubts about the long-term growth prospects for stocks like NVIDIA.

The growing awareness of AI-related risks, such as data privacy violations, misinformation, ethical dilemmas, and algorithmic biases, are prompting closer scrutiny of the technology. Media outlets are reporting on the unintended consequences of AI, from recurrent blunders in AI recommendations to legal disputes over AI-generated content. These developments underscore the need for a more critical evaluation of AI applications and their potential impact on society, as well as on the companies that rely on AI technologies for growth and profitability.

Investors holding NVIDIA shares are advised to consider the complexity and risks associated with AI technologies that could affect the company’s performance and stock value. While the current surge in the stock price reflects the strong belief in the potential of AI and NVIDIA chips, there is uncertainty about the sustainability of this growth trajectory. The effectiveness of the hype surrounding AI may not be sustainable in the long run, raising questions about the future prospects for NVIDIA and other AI-related companies. Stakeholders are urged to closely monitor developments in AI technology and its implications for the financial markets.