Despite the Fed’s commitment to keeping interest rates high for an extended period and signs of weakness in U.S. economic data, equity markets rebounded in the second week of May. The Nasdaq rose by 1.1%, while the S&P 500 and DJIA showed even stronger gains of 1.85% and 2.16%, respectively.

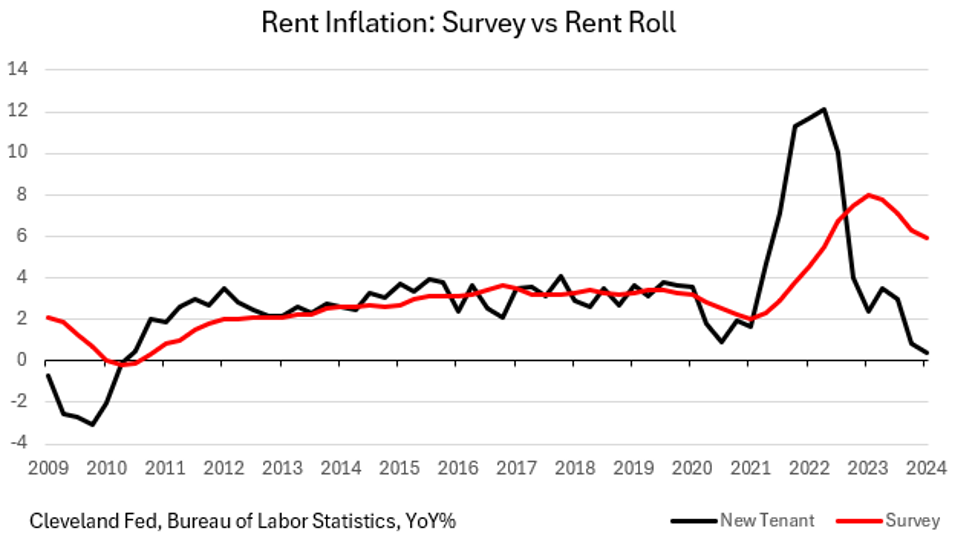

The U.S. CPI, which includes lagged rental data, has been impacted by declining rents in some cities over the past five quarters. This trend is expected to continue, driving CPI inflation lower as the year progresses. In comparison, the European HICP, which excludes owners’ equivalent rent, already shows consumer inflation in the U.S. at 1.9%, below the Fed’s 2% target.

The Fed closely monitors the PCE Deflator as its main inflation indicator. While goods prices are already deflating, services inflation, which includes shelter costs, remains relatively high. However, with shelter costs trending flat to down, services inflation is expected to decrease, leading to overall disinflation in the CPI for the rest of the year.

The Fed’s current tightening campaign, which began in March 2022, has lasted 26 months and appears to be achieving its goal of reducing inflation. However, this tight monetary policy is negatively impacting the real economy, as seen in the manufacturing sector’s prolonged recession and rising unemployment rates.

Consumers, who previously spent excess savings accumulated from government stimulus packages, are now facing record-high credit card balances and increasing loan delinquencies. This has led to a decline in consumer confidence, with retail sales showing little real growth and companies reporting lower sales despite high inflation.

Commercial real estate defaults continue, with notable properties like the Waldorf Astoria in D.C. and the Selena Hotel in Chicago facing financial troubles. Despite lower forward guidance from major companies like Starbucks and YUM Brands, equity markets continue to rally, reaching new highs, while the economy faces ongoing challenges.

Overall, it appears that inflation will continue to retreat for the rest of the year, with the Fed needing to reassess its monetary policy in light of the economic slowdown. With consumption driving a significant portion of GDP, the impact of restrictive monetary policy and exhausted consumer savings will likely lead to a continued economic slowdown, despite the resilience of the financial markets.