There is almost unanimous agreement that the Spanish economy is performing better than expected, and better than its EU partners. The only area of concern is investment, which has not yet reached 2019 levels. However, it is important to consider the three functions of investment in the economy. Firstly, it is a component of aggregate demand, which is volatile and plays a key role in the cyclical profile of GDP. Secondly, it contributes to capital stock in the medium to long term, which workers combine with their efforts in producing goods and services. Lastly, it helps spread technological progress through new capital goods.

The evaluation of investment should be done from these three perspectives, all of which are relevant but may not always align. In the short-term perspective, investment has played a modest role in the economic recovery post-pandemic. Private investment has not yet reached its 2019 levels in 2023, while public investment is benefiting from new European policies to overcome the pandemic, although at a slower pace than expected. From the standpoint of economic growth, what matters is the investment effort made over extended periods and its impact on capital per worker. Spain has a high level of productive capital per hour worked due to the significant investment effort over time.

Although Spain is not lacking in productive capital, there are issues with the composition of the capital assets, particularly in terms of technology and research and development (R&D). Improvements in this area have been slowed by the fall in investment during the 2019-2023 period. Spain ranks poorly in technology and R&D assets compared to other developed countries. While some assets have seen growth, such as communications and R&D, there is still a gap to close. Public investment has shown notable growth since 2019, but it remains below pre-Great Recession levels when it was used as a fiscal adjustment variable.

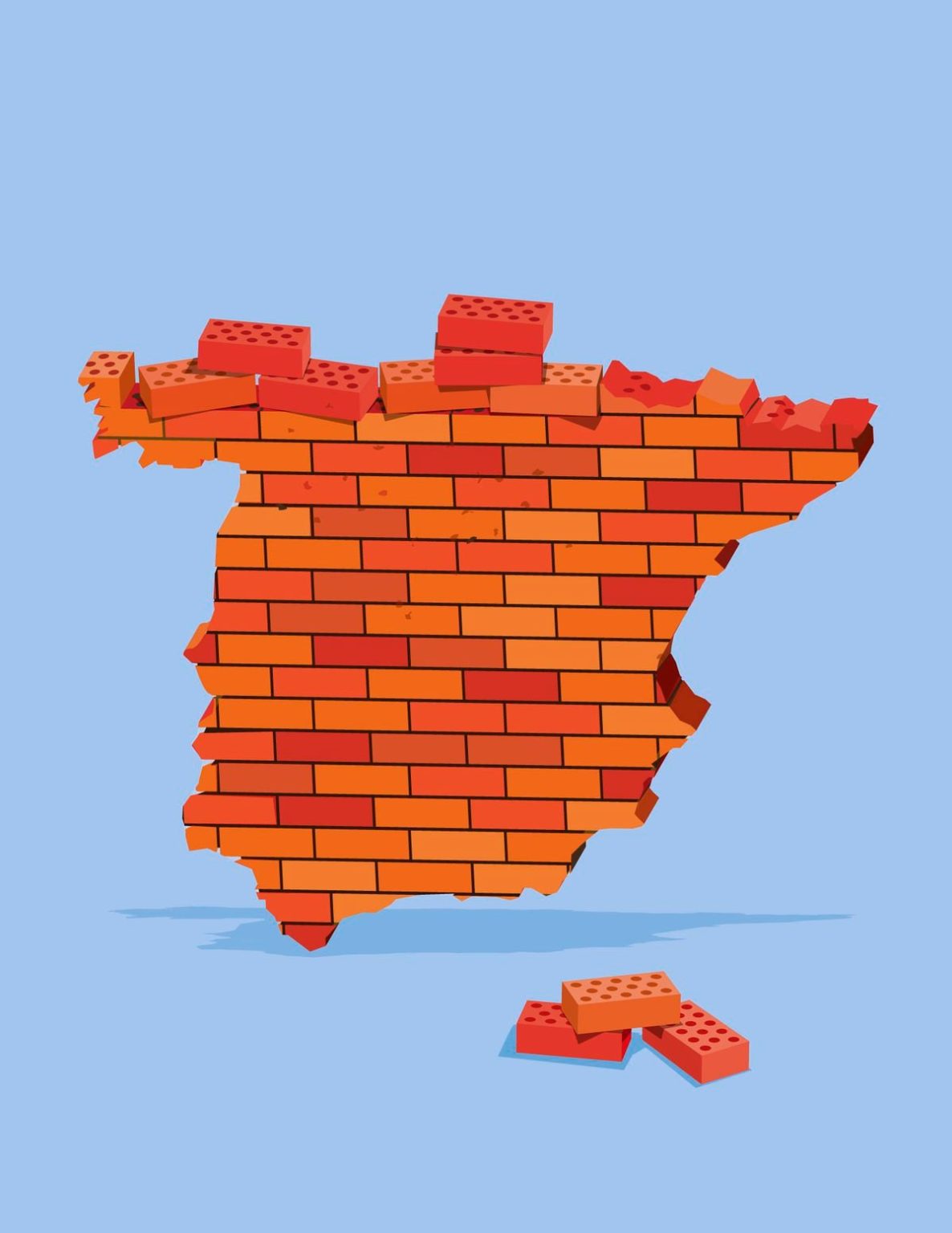

Overall, Spain does not have an investment or capital stock problem, but rather a composition issue. The country has suffered from a bias towards real estate investment in the past, and a lack of assets related to knowledge such as technology and R&D. These deficiencies are gradually being addressed, but hesitations in changing the investment structure are still hampering potential GDP growth and productivity. Progress in improving the composition of investment is necessary for sustaining long-term economic growth and competitiveness.