Nvidia’s quarterly earnings report from last April caused a surge in the interest in generative AI stocks globally. As the anniversary of this report approaches, there is speculation about whether Nvidia’s stock has reached its peak or will rise to a new high on May 22 when the company releases its first-quarter results for fiscal year 2025. Analysts have raised their price targets for Nvidia’s stock, with Morgan Stanley setting a target of $1,000, citing several reasons for optimism.

One of the main reasons for this optimism is Nvidia’s consistent performance in exceeding expectations over the past year. The company has beaten Wall Street expectations for the last four quarters, with significant increases in earnings per share. This trend has led to an increase in Nvidia’s stock price, which has seen a 236% rise in 2023 and a 79% rise so far in 2024. However, there are concerns that the extent to which Nvidia’s earnings exceed expectations is steadily dropping, which could impact the stock price in the future.

Nvidia’s strong performance is driven by high demand for its GPUs, particularly in the AI market. The company’s GPUs are in high demand, with major customers such as Microsoft, Google, and Meta Platforms investing billions in AI and cloud initiatives. Nvidia’s gross margins have also increased, reaching 76% in the fourth quarter of 2024 and expected to rise to 77% in the first quarter of fiscal year 2025. These factors contribute to Nvidia’s sustainable competitive advantages in the market.

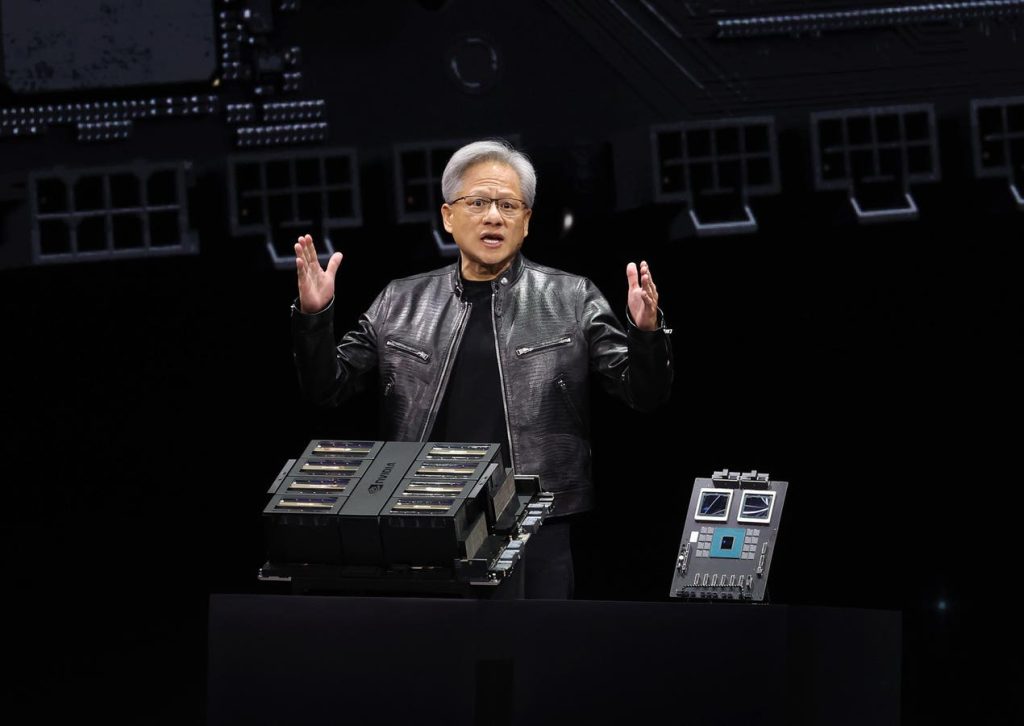

Nvidia’s market power is supported by its combination of chips and developer software, which create barriers to entry for competitors. The company has a dominant share of the AI chip industry, and its products are preferred by customers due to their performance and efficiency. Nvidia’s launch of the Blackwell GPU, a new chip architecture for inferencing, has received positive feedback from analysts, who believe it will maintain Nvidia’s technical lead and widen its competitive moat. However, rival companies such as AMD, Intel, and Google are also making efforts to gain market share in the AI chip industry.

As Nvidia prepares to report its first-quarter 2025 earnings, there are high expectations from investors regarding the company’s performance. Analysts have forecast significant growth in net sales, gross margins, and adjusted earnings per share for the first quarter of fiscal year 2025. The company’s guidance for revenue growth in the second quarter will also be a key factor in determining the stock price movement. While many analysts are bullish on Nvidia’s stock, some are cautious about potential cyclical downturns in the future due to shrinking models and changes in demand dynamics.