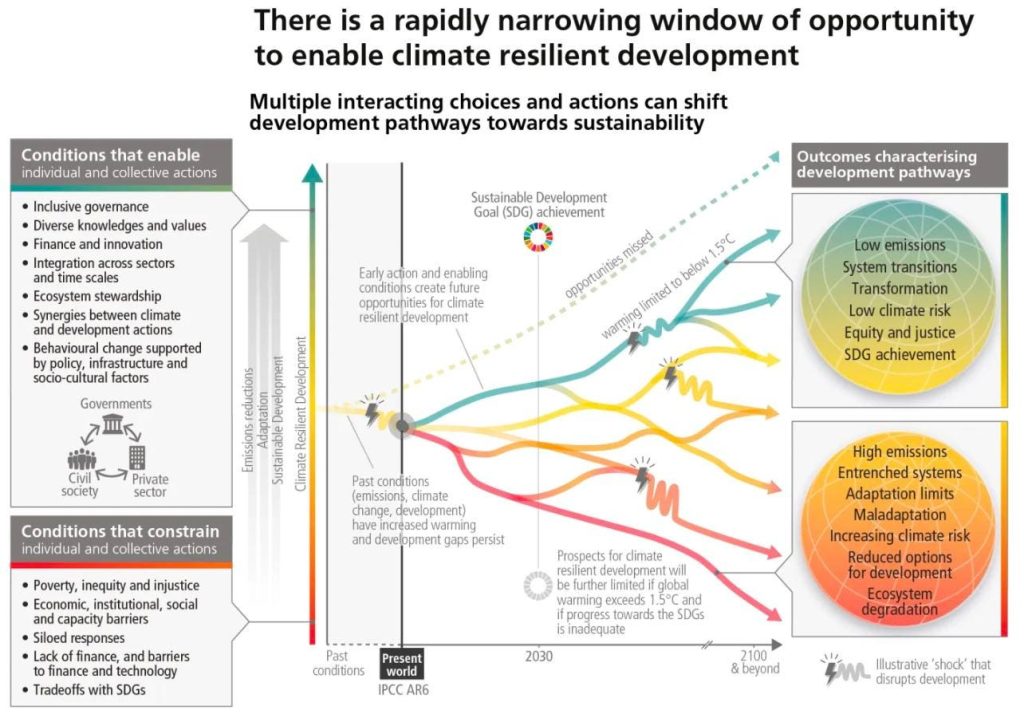

The world is currently on track to invest a record amount of USD 1.8 trillion in clean energy in 2023, but experts argue that this number needs to more than double to USD 4.5 trillion annually by the early 2030s in order to align with the 1.5°C target set by the Intergovernmental Panel on Climate Change (IPCC). The key enabling conditions for progress, as identified by the IPCC, include finance and innovation. However, there are still barriers that need to be overcome in order to redirect capital towards climate action and accelerate the adoption of new technologies and practices.

One of the crucial levers in moving the needle on climate change is finance, which plays a major role in funding the development and implementation of new technologies and innovations. Venture financing, in particular, is essential in supporting the businesses of the future and defining the set of future solutions. With the urgency of the climate crisis at hand, it is argued that more funding should be directed towards creating a livable future, rather than traditional sectors that may not align with sustainable development goals.

In 2023, climate tech accounted for only 10% of VC and PE funding in private market start-up investments, highlighting a potential funding gap of $2 trillion for next-generation climate technologies by 2030. This gap is critical in order to limit global temperatures to 1.5°C by the end of this decade. Increased funding across all climate tech areas is necessary to enable breakthrough innovations and trigger sectoral tipping points, while also supporting the scaling up of commercially ready technologies.

Climate tech venture investing not only plays a crucial role in reducing climate change but also offers significant financial returns. While some climate technologies have moved beyond the proof of concept stage, there is still untapped potential in many areas. By investing in climate tech, individuals can make a positive impact on the world and contribute to a sustainable future for current and future generations. Many believe that this could be the biggest investment opportunity in history, with the potential to drive significant change in the way we approach energy, finance, and talent allocation.

Ultimately, redirecting energy, capital, and human resources towards climate tech venture investing can help facilitate the transition to a more sustainable and carbon-neutral economy. This shift is crucial in achieving global climate goals and creating a more resilient and environmentally friendly world. By investing in climate tech, individuals and businesses have the opportunity to be at the forefront of innovation and play a key role in shaping the future for generations to come.