According to the Consumer Price Index, the cost of goods that people typically buy has risen by about 20% since 2020. To compensate for this increase in prices, compensation must also rise by at least as much. However, the government reports that real compensation has only risen by -2%, indicating that prices are rising faster than incomes. This is particularly challenging for consumers in the lower half of the income distribution who may struggle to afford basic necessities.

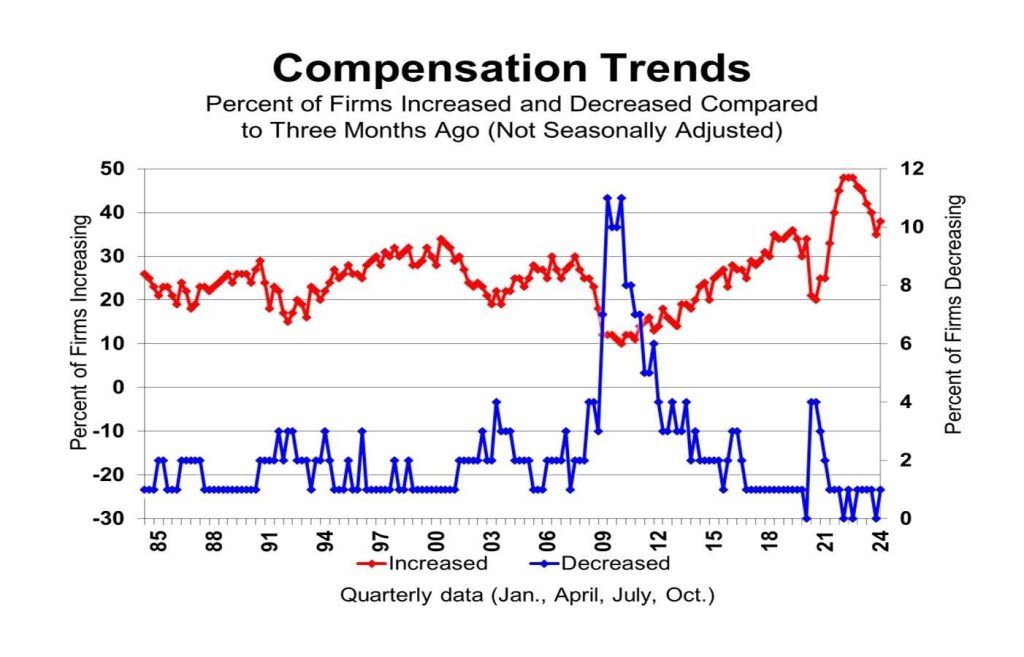

Small business owners have been increasing compensation rates aggressively in order to retain and attract workers due to competition in the labor market. Labor costs are a significant expense for most small firms, prompting them to prioritize competitive compensation. While compensation reductions are rare, with only 3% or less of firms reporting cuts in any given quarter, the 2008-2009 recession saw as many as 11% of firms making cuts. In contrast, recent years have seen record-high levels of firms reporting compensation increases.

The trend of firms raising compensation rates has been coupled with a high number of firms raising selling prices to cover the increased costs. This has limited the impact of these pay raises on reducing inflation. Recessions have historically triggered a reduction in compensation raising activity, as seen during the 2008-2009 recession and the recent Covid shutdown period. The gap between planned compensation increases and actual raises grows as the economy expands, indicating that later in the economic cycle, raises are reactionary rather than planned.

While the frequency of wage increases has slightly decreased, it remains at historically high levels, keeping pressure on labor costs and ultimately, prices for consumers. Despite a slight decline in the percentage of firms raising compensation rates since December 2023, levels are still elevated compared to pre-2020. This indicates that firms are still facing significant pressure to raise prices, which could hinder the Federal Reserve’s efforts to lower inflation. Unless there is a significant decline in the economy, achieving a return to 2% inflation may be challenging as labor cost pressures persist.

Overall, the data suggests that the rise in inflation and labor costs is putting a strain on both businesses and consumers. While small businesses are increasing compensation rates to attract and retain workers, they are also facing pressure to raise prices to cover these costs. This could lead to challenges for the Federal Reserve in their efforts to lower inflation rates. Without significant economic changes, it may be difficult to see a quick return to lower inflation levels in the near future.