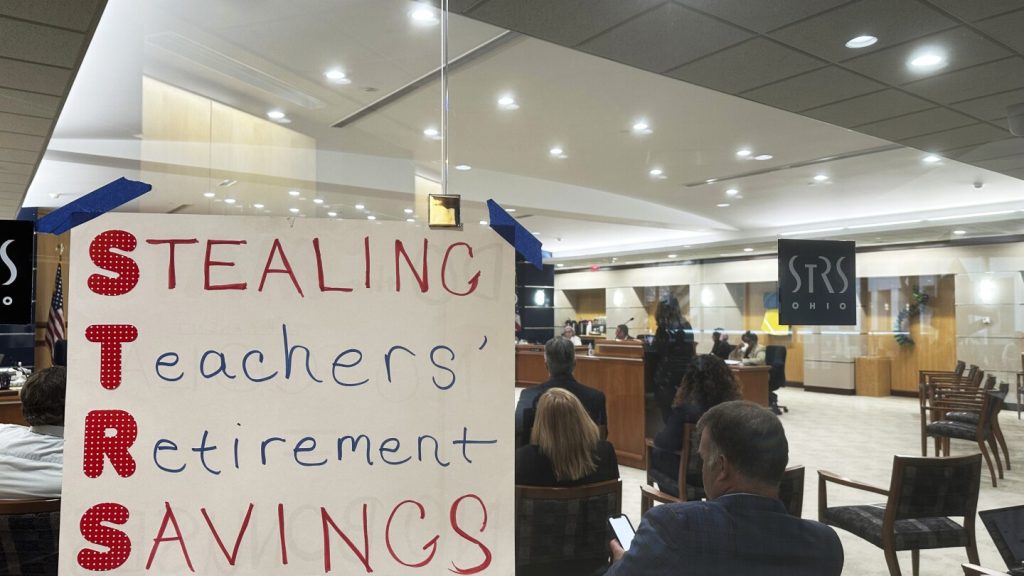

Ohio’s State Teachers Retirement System is at the center of a heated battle over the future of the $94 billion fund. Reformers are pushing for changes that would benefit retirees, including implementing an AI-driven trading strategy with the help of a controversial investment firm. However, this move has sparked intense scrutiny and led to accusations of misconduct and conflicts of interest. The Attorney General has launched an investigation into the fund’s vulnerability to private interests and has filed a lawsuit to remove two board members who support the reform plan.

The Ohio Retirement for Teachers Association, a watchdog group, has defended the reformers’ efforts as a necessary response to years of opaque management and dissatisfaction among retirees. Teachers who rely on the fund for their retirement income have long called for more transparency and fairness in investment and pay practices. The reformers argue that the fund’s current management has failed to provide adequate cost-of-living adjustments and has incurred market losses, while investment professionals have received significant bonuses. The push for change has become a contentious issue, with Governor DeWine and the Attorney General facing backlash for their involvement in the dispute.

As the battle over the STRS fund continues, questions have been raised about the legitimacy of the proposed AI-driven trading strategy by the investment firm QED. Critics argue that entrusting such a significant portion of the fund’s assets to a relatively unknown firm poses a serious risk to the fund’s stability and solvency. Former officials and experts have expressed concerns about the potential consequences of implementing untested investment strategies and have called for more caution in decision-making. The ongoing investigation into the fund’s management and the involvement of outside entities has further complicated the situation.

The recent developments at STRS have reignited debates about the role of public pensions and the need for transparency and accountability in managing such significant funds. The shift towards more complex and risky investment strategies in the public pension sector has raised concerns about the potential impact on retirees and the long-term sustainability of pension funds. The controversy surrounding the reform efforts at STRS highlights the challenges faced by retirement systems in balancing financial growth with responsible management practices. The outcome of the battle for control of the fund will have far-reaching implications for teachers and retirees in Ohio.

Despite the legal challenges and investigations, the reformers at STRS have remained steadfast in their efforts to bring about change and improve the fund’s performance for retirees. The recent shift in leadership on the board and the election of a new chairperson signal a turning point in the ongoing struggle for control of the fund. Retired teachers, who have long awaited better benefits and management practices, have voiced their support for the reformers’ initiatives and are hopeful for a positive outcome. The future of Ohio’s State Teachers Retirement System remains uncertain, but the determination of those advocating for reform suggests that significant changes may be on the horizon.